What’s behind ETP’s Strong Distributable Cash Flow Growth?

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16.

Dec. 7 2017, Updated 10:32 a.m. ET

Why are distributable cash flows important?

DCF (distributable cash flow), a commonly used measure of MLP performance, is broadly calculated as EBITDA (earnings before interest, taxes, depreciation, and amortization) less interest, tax, and maintenance capital expenditures. MLPs distribute a substantial part of generated cash flow to investors, which makes DCF an important metric for evaluating an MLP’s performance.

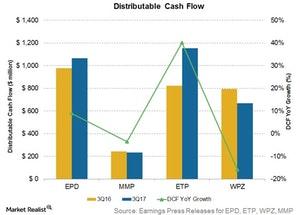

The above graph compares the DCF of Enterprise Products Partners (EPD), Energy Transfer Partners (ETP), Magellan Midstream Partners (MMP), and Williams Partners (WPZ) for 3Q17 with 3Q16. The right axis shows the YoY (year-over-year) growth in DCF for the four MLPs. Magellan Midstream Partners and Williams Partners recorded negative YoY growth in DCF in 3Q17.

Among the four MLPs, Energy Transfer Partners’ DCF grew the most in 3Q17 over the year-ago quarter. Its DCF increased 27.5% YoY. EPD followed ETP with 8.9% YoY growth.

Energy Transfer Partners’ DCF

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16. The YoY growth in ETP’s 3Q17 DCF was mainly due to EBITDA (earnings before interest, tax, depreciation, and amortization) growth during the quarter. ETP’s 3Q17 EBITDA growth was driven by the strong performance of its crude oil transportation and services segment.

ETP’s DCF for 3Q17 and 3Q16 in the chart above reflects the pro forma impacts of the merger with Sunoco Logistics as if the merger happened on January 1, 2016. The merger was completed on April 28, 2017.

Williams Partners’ DCF

Williams Partners’ DCF fell 15.8% YoY to $669 million in 3Q17 compared to $795 million in 3Q16. The 3Q17 DCF was negatively impacted by the absence of contributions from the Geismar olefins facility, which was sold on July 6, 2017. WPZ’s DCF was also impacted by the removal of non-cash deferred revenue amortization associated with some contract restructurings in 4Q16.