Are Stock Returns during Summer Months That Bad?

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign.

May 18 2017, Published 1:09 p.m. ET

Direxion

Biotech stays healthy in the summertime

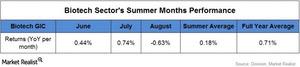

Even though the Biotech and Life Sciences GIC underperform themselves during the rest of the year, they do stay positive during the summer and easily outperform the S&P 500 by 30 basis points. This is again somewhat surprising, as many people think of summer as a risk-off time when in fact it is a good time to stay invested in Biotechnology stocks historically. The GIC has done well since the election despite Donald Trump’s considerable rhetoric talking down drug prices (with of course no backup to that). It jumped massively the day after the election, as many thought Hillary Clinton would have been tougher on drug companies. Recently the index has given some back along with the rest of the market. Here are the summer returns for Biotech:[1.Past performance is not indicative of future returns.]

Conclusion: Summer returns aren’t all bad, but sectors matter

Interestingly, two of the highest beta sectors, Semis and Biotech, outperform during the summer. The S&P500 is slightly down, while Energy can’t seem to catch a break. But as always in investing, returns are never like the averages and never just like the past. This year more than most, exogenous (mainly regulatory) forces can have an outsized effect on the markets and sectors. So whether you want to bet on seasonality or look through, Direxion has a range of Leveraged ETFs to express your investing views from the beach this summer.[2.Past performance is not indicative of future returns.]

Market Realist

Biotech stocks cool off during summer

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign, as it has been a significant topic of discussion. Fear arose from Trump’s administrative plans to revive the health care sector, as his first executive order after being sworn in as president was to take prompt action to repeal the Affordable Care Act (or ACA). These actions could affect hospital stocks adversely while benefiting life science companies and pharmaceuticals.

Despite the fact that President Trump plans to allow US manufactured drugs to be reimported and to require price transparency from all health care providers could affect hospitals and drug manufacturers, the biotech sector (XBI) has risen 18% since elections. The overall health care sector (XLV), on the other hand, has risen only 6% since elections as of May 8, 2017.

The table above shows that on average, biotech has had positive returns during the summer months. The Direxion Daily S&P Biotech 3X Bull ETF (LABU), which has also outperformed compared to the Direxion Daily Healthcare Bull 3X ETF (CURE), has risen 44% since elections as of May 8, 2017.

Overall summer returns haven’t been all that bad. However, this summer, they seem to rely heavily on regulatory changes that are proposed and expected from the new administration. Investors need to carefully watch how these regulations, the improving economy, and rising interest rates drive the returns of each sector and the S&P 500 overall over the coming months. As we discussed in this series, investors can consider Direxion’s wide range of leveraged ETFs for each sector.

The Net Expense Ratio includes management fees, other operating expenses and Acquired Fund Fees and Expenses. If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be 0.95%. The Funds’ Adviser, Rafferty Asset Management, LLC (“Rafferty”) has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contractually agreed to cap all or a portion of its management fee and/or reimburse each Fund for Other Expenses through September 1, 2018, to the extent that the Fund’s Total Annual Fund Operating Expenses exceed 0.95% of the Fund’s daily net assets other than the following: taxes, swap financing and related costs, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions and extraordinary expenses. If these expenses were included, the expense ratio would be higher.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized. For the most recent month-end performance please visit the funds website at direxioninvestments.com.