Substantial Asia Exposure Could Improve Risk-Adjusted Returns

A higher allocation to Asia could certainly provide diversification benefits to investors while enhancing their risk-adjusted returns.

June 2 2017, Updated 9:06 a.m. ET

Matthews Asia

Summary: Investing in Asia

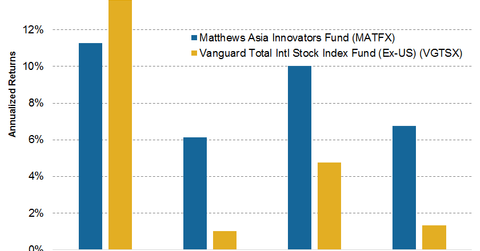

Investors can capture much more of the potential for investing in Asia than they currently do. Underweighted, and often allocating to the “wrong kind of Asia,” investors may benefit from rethinking how they approach Asia. The region’s markets demonstrate low correlations with the U.S., significant return potential, and evidence that active management has worked. Instead of looking at Asia as an exotic “add-on” to an EAFE allocation, there’s a strong case for using Asia rather than EAFE as the anchor of international diversification. The original motivation for investing abroad was to find faster growing companies in markets with low correlations with the U.S. That concept today is far more applicable to Asia than anywhere else in the investing world. Instead of looking at Asia as an exotic “add-on” to an international allocation, we believe there’s a strong case for using a dedicated and substantial Asia exposure to improve both returns and international diversification.

Market Realist

Asia is the world’s fastest-growing region

More than 50% of the world’s population lives in Asia (FXI) (INDA). While developed markets are aging, Asia is still young and acquiring skills at a quicker pace, which could provide a huge impetus to its future growth. Its expanding middle class and rapid rise in income levels may ensure higher consumer spending in the years to come, thereby boosting its economy and corporate growth. Asian markets (AAXJ) are already growing rapidly compared with the rest of the world, and indicators suggest that it will continue its rise in the global economy.

US investors need to shun their home bias

Asia is home to some of the best companies (EWY) (EWT) in the world, and these companies have become highly valuable in a short period. To tap into these immense opportunities, US investors need to shun their home bias and allocate part of their portfolios to Asia. Historically, US investors have remained persistently underweight on Asia, missing out on long-term capital appreciation opportunities. Although many investors tried to diversify away from the US by investing in other developed and emerging markets, these markets are not true proxies to high-growth Asian markets. In fact, many non-US global funds have a small allocation to Asia’s fastest growing markets, while leaning towards commodity-driven markets.

A higher allocation to Asia could certainly provide diversification benefits to investors while enhancing their risk-adjusted returns.