How MLP Funds Performed in April 2017

Among MLP funds, ETFs were the top performers in terms of total returns in April, while ETNs were the bottom performers.

Nov. 20 2020, Updated 3:54 p.m. ET

MLP funds underperformed the SPY

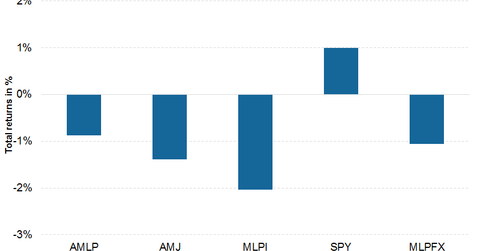

In this article, we’ll analyze the performance of MLP-focused funds in April 2017. MLP-focused funds underperformed the SPDR S&P 500 ETF (SPY) in April 2017. The performances of some well-known MLP funds relative to SPY are as follows:

- The Alerian MLP ETF (AMLP): -1.9%

- The JPMorgan Alerian MLP ETN (AMJ): -2.4%

- The UBS ETRACS Alerian MLP Infras ETN (MLPI): -3.0%

- The Oppenheimer SteelPath MLP Select 40 A (MLPFX): -2.1%

Oppenheimer SteelPath MLP Select 40 A is an MLP-focused open-ended fund.

ETFs versus other MLP funds

Among MLP funds, ETFs were the top performers in terms of total returns in April, while ETNs were the bottom performers. An MLP ETF and an ETN tracking the same index differ in performance due to different tax consequences. MLP ETFs are generally structured as C-corporations, which means they have to pay corporate taxes on distributions before distributions are passed to investors. This results in a difference in performance of MLP ETFs and the underlying MLPs.

In comparison, ETNs don’t pay any taxes on distribution, resulting in better performance tracking with the MLP indices. However, distributions are treated as taxable income in this case. Investors can avoid these tax consequences or tracking errors by investing directly in MLPs, but then investors have to undergo the complicated process of filing K-1 forms. For more detail on MLPs’ tax structure, read Tax Consideration: How Are MLP Investors Taxed?