How Medtronic’s CVG Segment Performed in Fiscal 4Q17

Medtronic (MDT) reported ~$7.9 billion in worldwide revenues in fiscal 4Q17.

May 30 2017, Updated 1:05 p.m. ET

CVG segment in fiscal 4Q17

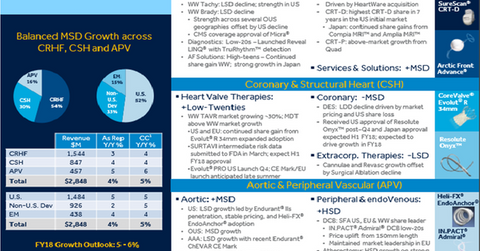

Medtronic (MDT) reported ~$7.9 billion in worldwide revenues in fiscal 4Q17. Of that total, ~$2.8 billion came from Medtronic’s CVG (Cardiac and Vascular Group) segment, representing ~36% of the company’s total revenues. These sales figures represent a ~5% YoY (year-over-year) rise in fiscal 4Q17 on a constant currency basis. This is in-line with the company’s expected CVG revenue growth in the mid-single-digit range.

The US segment sales registered strong YoY growth of ~5%. However, Medtronic noted comparatively weaker YoY CVG segment sales of ~2% and ~4% in non-US developed markets and emerging markets, respectively. This was due to the negative currency impact. The CRHF (Cardiac Rhythm and Heart Failure) division registered a growth rate of around 3%, whereas the CSH (Coronary and Structural Heart) division’s growth was around 4%. The APV (Aortic and Peripheral Vascular) division registered strong YoY growth of around 5% on a reported basis.

Medtronic’s major competitors in the cardiovascular market in the US include Edwards Lifesciences (EW), Abbott Laboratories (ABT), and Boston Scientific (BSX), which reported YoY sales growth of 18%, 30%, and 10%, respectively, in their most recent quarters. The iShares Russell 1000 ETF (IWB) invests ~0.52% of its total holdings in MDT.

Growth drivers

All the businesses across the CVG segment reported strong growth in 4Q17. The CRHF division reported mid-single-digit growth with its atrial fibrillation solutions registering a high teen growth driven by continued share gain across the globe. The Heartware acquisition drove heart failure segment growth. For details on the acquisition, read HeartWare’s HVAD System Accelerates Medtronic’s Growth in Europe.

The CSH division registered mid-single-digit sales growth in fiscal 4Q17 as Medtronic registered strong TAVR (transcatheter aortic valve replacement) growth. In TAVR, Medtronic accelerated its share gains in Europe and the United States with its launch of its Evolut R 34 mm valve. The division’s sales were weighed down, however, by weakness in the DES (Drug-Eluting Stents) business, which witnessed a low-double-digit fall due to the pricing impact and loss in US market share.

APV division sales were driven by stable pricing, improved penetration of its Endurant II device, and continued adoption of its Heli-FX Endo-anchor system.

In the next article, we’ll look at the fiscal 4Q17 performance of Medtronic’s Minimally Invasive Therapies Group.