Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

Nov. 20 2020, Updated 3:41 p.m. ET

George Soros’s position in the iShares Russell 2000

According to its recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter. Currently, the firm holds 3.3 million shares of the iShares Russell 2000 puts.

IWM performance

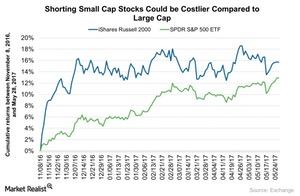

On a year-to-date (or YTD) basis, the iShares Russell 2000 ETF (IWM) rose 2.0%. On a month-to-date (or MTD) basis, it fell 1.1% as of May 26, 2017. Since the US (QQQ) (VFINX) presidential election on November 8, 2016, IWM has risen 15.7% as of May 26.

Soros Fund Management’s short position in the S&P 500 resulted in a loss in the first quarter. Since the US election outcome, George Soros has become bearish on Donald Trump’s various agendas.

Comparison between the S&P 500 and the iShares Russell 2000

The iShares Russell 2000 (IWM) has outperformed the SPDR S&P 500 ETF (SPY) since the US presidential election on November 8, 2016. However, on a YTD and month-to-date basis, the SPDR S&P 500 ETF has outperformed the iShares Russell 2000 (IWM) ETF as of May 26, 2017.

There was a large surge in US small-cap stocks just after US presidential elections compared to large-cap stocks as the graph above shows. However, between January 2017 and March 2017, large-cap companies rose continuously. Better macroeconomic indicators and improving conditions for the US economy mainly contributed to the gain in US large-cap stocks over this time period.

In the next part of this series, we’ll analyze George Soros’s current investment in media stocks.