Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

Dec. 4 2020, Updated 10:52 a.m. ET

Lower valuations

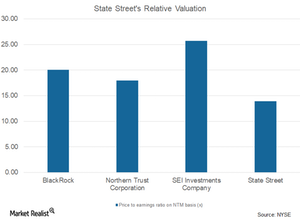

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x, which reflects the discounted valuations of the company. Competitors BlackRock (BLK), Northern Trust (NTRS), and SEI Investments (SEIC) have PE ratios on a next 12-month basis of 20.05x, 17.93x, and 25.69x, respectively.

State Street Global Advisors looks after State Street’s asset management business. Its positive outlook on equities for 2018 could improve State Street’s valuations in the near future. The company’s focus on attaining the financial objectives of 2017 could further improve its valuations.

Benefits to shareholders

In the first nine months of 2017, State Street has declared dividends of $1.18 per share, which amounts to $442 million. During the same period in 2016, it declared dividends of $1.06 per share, which amounted to $414 million.

However, State Street’s investment management division saw a substantial rise in pre-tax income in 3Q17 compared to 3Q16. That momentum is expected to continue in 2018, thus improving its valuations.

While State Street has a PE ratio of 16.77x on a last 12-month basis, its peers (XLF) SEI Investments (SEIC), BlackRock (BLK), and Northern Trust (NTRS) have PE ratios of 30.88x, 23.99x, and 21.50x, respectively.