Northern Trust Corp

Latest Northern Trust Corp News and Updates

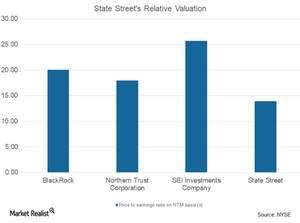

Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

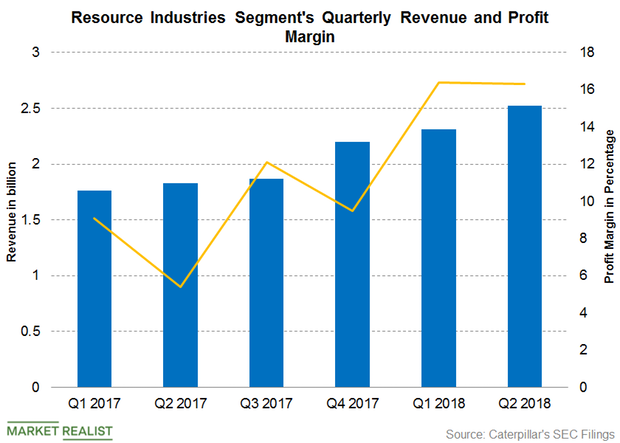

Analyzing Caterpillar’s Resource Industries Segment

Caterpillar’s Resource Industries segment is the company’s lowest revenue contributor. The segment had a revenue share of 18% in the second quarter.