Inside Bio-Rad Laboratories’ Robust Revenue Growth Projection for 2017

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%.

May 22 2017, Updated 12:36 p.m. ET

Robust revenue growth

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%. The company has also projected currency-neutral YoY (year-over-year) revenue growth of around 4% for fiscal 2017.

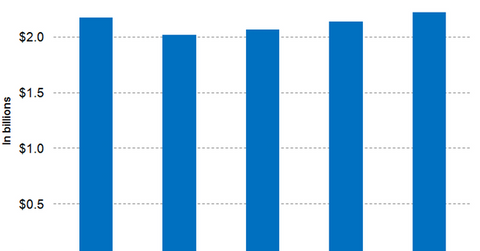

For fiscal 2017, Wall Street analysts have projected that Bio-Rad Laboratories’ total revenues will be around $2.1 billion, which would represent a YoY growth of ~3.2%.

In 2017, peers PerkinElmer (PKI), Danaher (DHR), and Thermo Fisher Scientific (TMO) are expected to report revenues of around $2.2 billion, $17.9 billion, and $19.6 billion, respectively.

Revenue trends in 1Q17

In 1Q17, autoimmune products, blood typing, western blotting, and Droplet Digital PCR (polymerase chain reaction) products contributed significantly to Bio-Rad’s revenue growth. While the company’s sales were slightly lower in the US and Japan, the impact was partly offset by higher demand for Bio-Rad’s products in Europe, China, and Asia-Pacific.

Some orders from the European market were pulled forward ahead of the company’s deployment of its new SAP system. However, even after excluding this effect, the company witnessed a healthy YoY rise in sales from European markets on a currency neutral basis.

Bio-Rad’s gross margin

Despite the rise in revenues, Bio-Rad Laboratories witnessed a drop in gross margins in 1Q17, mainly due to a $10-million, one-time expense related to the acquisition of RainDance Technologies. The company’s gross margin also suffered due to the increasing costs associated with the set-up of its new supply chain model in Europe. These negative effects were partly offset by a favorable product mix and reduced amortization expenses.

Notably, the Vanguard Small-Cap ETF (VB) has about 0.14% of its total portfolio holdings in Bio-Rad Laboratories.

Continue to the next part for a closer look at Bio-Rad Laboratories’ margin projections.