PerkinElmer Inc

Latest PerkinElmer Inc News and Updates

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

What Bio-Rad Laboratories Expects from Life Science

In 1Q17, Bio-Rad Laboratories’ (BIO) Life Science segment reported revenues of ~$174.3 million, which represents a YoY rise of ~5.1%.

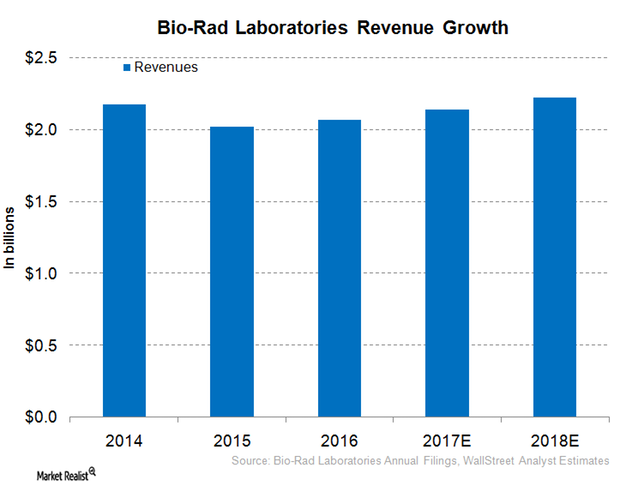

Inside Bio-Rad Laboratories’ Robust Revenue Growth Projection for 2017

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%.