Asian Markets Could Generate Higher Returns

In the short term, Asian benchmarks and ETFs have also performed better than US-focused funds.

Nov. 20 2020, Updated 11:34 a.m. ET

Matthews Asia

While the success of active management in U.S. equities is widely debated, Asian active funds, on average, have done materially better against their benchmarks than their U.S. counterparts. Compared to Asia, the U.S. is a relatively efficient market dominated by institutional investors. To a significantly greater degree than in the U.S., Asia-focused professional money managers compete with individuals and entities that do not always appear to rely on company fundamentals. Ultimately, markets follow those fundamentals and so in the short-term this can lead to big gaps between a company’s stock price and its intrinsic value, providing opportunities for active managers.

That’s the theory. But how has it worked in practice?

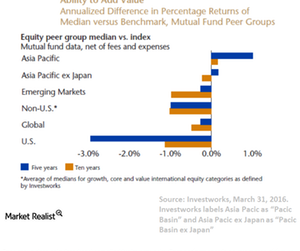

Using the rather stringent test of mutual fund performance net of fees and expenses, we show how the median equity fund has performed against its index over five and ten years for the Asian region and the global fund universe. The only peer groups in this list where the median equity fund beat its index over the five years to end 2015 were Asia and Asia ex-Japan. Reflecting the more competitive and efficient U.S. market environment, the median U.S. equity fund finished at the bottom of this ranking in both periods. This tends to support the hypothesis that active managers can find more opportunities in Asia than their competitors can in the U.S. or across the range of non-U.S. markets.

Market Realist

Asian markets could offer higher returns in the short term

As discussed above, many Asian funds have delivered a better performance than US markets. In the short term, Asian benchmarks and ETFs have also performed better than US-focused funds. The iShares MSCI All Country Asia ex Japan ETF (AAXJ) generated a return of 8.9% in the three months ended April 30, 2017, while the iShares Core S&P 500 ETF (IVV) returned 4.7%. Similarly, in the year ended April 30, 2017, AAXJ outperformed IVV with a return of 18.4% against AAXJ’s 16.4%. The iShares Asia 50 ETF (AIA) earned even higher returns of 7.9% in the three-month period and 24.3% for the year.

A comparison of the SPDR US and Asia ETFs reveals the same pattern. The SPDR S&P 500 ETF (SPY) generated a 4.7% return in the three months ended April 30, 2017, and 16.3% in the year. These returns pale in comparison to those of the SPDR S&P Emerging Asia Pacific ETF (GMF), which returned 9.2% and 20.2% during these periods, respectively.

Some individual countries’ markets have outperformed US markets. For example, the iShares MSCI India Small Cap ETF (SMIN) earned 41.8% in the year ended April 30, while the Global X MSCI Pakistan ETF (PAK) earned 36.5%. The iShares Core S&P Small Cap ETF (IJR) returned just 23.3%.