Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

May 30 2017, Published 2:24 p.m. ET

Mining stock evaluation

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. While there are many important indicators that investors can keep track of during these times of speculation, we’ll focus here on 14-day RSI (relative strength index) scores and implied volatility.

The ETFS Physical Silver (SIVR) and the ETFS Physical Swiss Gold (SGOL) have regained 3.2% and 0.58%, respectively, on a trailing five-day basis, likely due to the recent rebound in precious metals. But mining shares have seen losses over the past few days, regardless of this rebound.

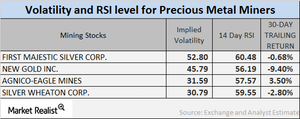

Implied volatility

Call implied volatility considers changes in an asset’s price, given variations in the price of its call option. In times of market turbulence, volatility usually rises.

On May 25, 2017, the implied volatilities of Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Gold Fields (GFI) stood at 26.6%, 30.5%, 52.6%, and 9.3%, respectively. Remember, mining company volatility is often higher than precious metals volatility.

RSI scores

A 14-day RSI score above 70 tells us that a stock price might fall, but a score below 30 indicates that a stock price could rise. The four previously mentioned miners’ scores have risen due to their higher stock prices.

RSI scores often revive and fall along with rises and falls in companies’ shares, respectively. Royal Gold, Goldcorp, New Gold, and Gold Fields now have RSI scores of 83.3, 48.7, 58, 78.3, respectively.