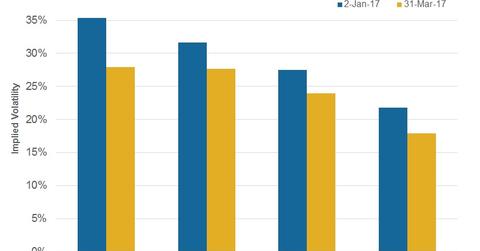

Refining Stocks’ Implied Volatilities Tumbled in 1Q17

Refining stocks’ implied volatilities have witnessed falls in 1Q17. Marathon Petroleum’s (MPC) implied volatility fell 7% to 27.9% from January 2 to March 31, 2017.

April 7 2017, Updated 9:05 a.m. ET

Implied volatilities in refining stocks

Refining stocks’ implied volatilities have witnessed falls in 1Q17. Marathon Petroleum’s (MPC) implied volatility fell 7% to 27.9% from January 2 to March 31, 2017. This fall was the highest among its peers Valero Energy (VLO), Tesoro (TSO), and Phillips 66 (PSX).

VLO, TSO, and PSX witnessed 4% falls each in their implied volatilities in 1Q17. Regarding absolute levels, implied volatility in MPC was the highest, whereas it was the lowest in PSX.

For exposure to MPC, TSO, VLO, and PSX, you can consider the iShares North American Natural Resources ETF (IGE). The ETF also has ~7% exposure to refining and marketing sector stocks.

Move on to the next article to read about how refining stocks’ PEG ratios compare.