Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

Nov. 20 2020, Updated 12:23 p.m. ET

Alcoa’s 1Q17 earnings call

Previously, we looked at analysts’ estimates for Alcoa’s (AA) 1Q17 earnings. In this part, we’ll analyze the key updates that markets (MDY) (MID-INDEX) are waiting for in Alcoa’s 1Q17 earnings call.

Industry outlook

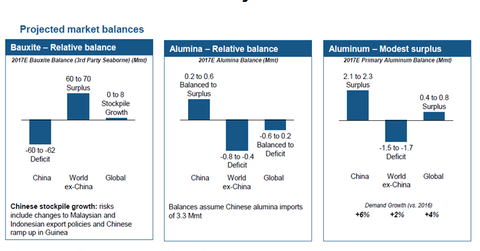

For commodity companies like Century Aluminum (CENX), the industry outlook is as important, if not more important, than the company’s position in the industry. During its 4Q16 earnings call, Alcoa said that it expects global aluminum markets to be in a surplus in 2017. You can define a “surplus” as production in excess of demand. Markets are said to be in a “deficit” when demand exceeds production.

Norsk Hydro (NHYDY) also expects aluminum markets to be in balance this year with expectations of a small surplus. However, RUSAL expects aluminum markets to be in a deficit this year. During its 1Q17 earnings call, markets will watch Alcoa management’s commentary on the aluminum industry’s outlook, especially on restarts of Chinese smelting capacity.

Company outlook

During its 4Q16 earnings call, Alcoa listed priorities for using its excess cash. With the stock taking a beating over the last few weeks, markets will look for cues from Alcoa’s management on whether the company could look at share buybacks as a tool to lift its sagging stock prices.

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa. However, in February, speaking with Bloomberg, Rio Tinto’s chief financial officer said that the deal wouldn’t “make much sense for Rio Tinto.” During its 1Q17 earnings call, markets would watch Alcoa management’s views on potential merger and acquisition activity to enhance shareholder value.

Don’t forget to check with our Aluminum page for Alcoa’s post-earnings analysis. Meanwhile, you can read, Does the Slide in Alcoa Stock Present a Buying Opportunity? to explore Alcoa’s outlook in more detail.