Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

Nov. 20 2020, Updated 1:23 p.m. ET

Marathon Petroleum’s stock performance

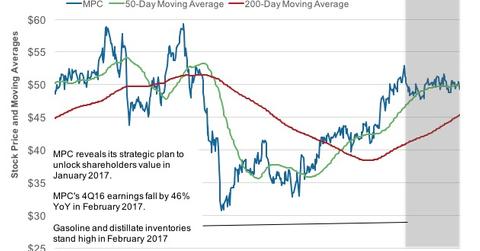

Marathon Petroleum (MPC) stock began 2017 on a positive note, staying above its 50-day and 200-day moving averages. This positivity came on the back of its strategic plan to unlock shareholder value, and MPC’s refining margin indicators had also risen at the beginning of the year.

But MPC tumbles in 2017

On February 1, 2017, Marathon Petroleum released its 4Q16 earnings, which showed a ~46% YoY (year-over-year) fall. These earnings were affected by RIN (renewable identification number) costs.

To add to its woes, in February 2017, the EIA (US Energy Information Administration) announced the five-year high distillate inventory for the week ending February 3, 2017. This announcement was followed by a high gasoline inventory for the week ending February 10, 2017, and now it’s been failing.

The beneficial effect of the rise in refining margin indicators on Marathon Petroleum stock was thus negated by the adverse impact of MPC’s 4Q16 earnings and high gasoline and distillate inventories across the industry.

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average, and now MPC is now trading below its 50-day moving average but above its 200-day moving average.

Peer stock performances

Since January 3, 2017, HollyFrontier (HFC), Western Refining (WNR), and PBF Energy (PBF) have fallen 19%, 10%, and 27%, respectively. For mid-cap stocks exposure, investors can consider the SPDR S&P MIDCAP 400 ETF (MDY). MDY has ~4% exposure to the energy sector stocks including HFC and WNR.

Continue to the next part for a look at the analyst ratings.