Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

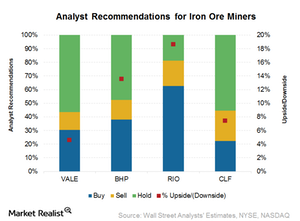

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

April 10 2017, Updated 7:36 a.m. ET

Factors impacting analyst sentiment

Although iron ore prices rose 18% in 1Q17 compared to 4Q16, they started falling toward the end of March 2017. After hitting a 30-month high of ~$95 per ton in February, iron ore prices settled at ~$80 per ton to end the quarter.

Investors should note that even at the current level of iron ore prices, companies are earning attractive margins. As a result, most of the mid-tier miners should be able to stay afloat. The concern is not that a correction has taken place in the last few weeks, but that prices could weaken further. This trend could put pressure on cash flows for miners going forward.

BHP and Rio Tinto

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings. One year earlier, 50% of these analysts were recommending a “buy” for the stock. Along with higher commodity prices, a reduction in its debt and robust cash flow encouraged analysts to turn positive on the stock. Its target price has also seen an upward revision of 44%.

BHP Billiton (BHP) comes in second, with 38% of the 21 analysts recommending a “buy.” One year ago, 48% of the analysts recommended a “buy” for the stock. Its target price has also seen an upward revision of 34% in the last year. However, this revision is lower than that seen by Rio Tinto stock.

While BHP’s target price implies an upward potential of 15%, Rio Tinto’s target price implies a 19% upside.

Vale SA and CLF

The analyst ratings for Vale SA (VALE) are tilted toward “hold,” with 57% of analysts making that recommendation. Out of 24 analysts covering VALE, 30% have a “buy” rating on the stock. In November 2016, only 15% of the analysts rated Vale as a “buy.” We’ll look at the reason for these upgrades in the next part of this series.

Cliffs Natural Resources (CLF) has 22% ratings each for “buy” and “hold.” Its target price implies an upside of 7.4% at the current market price of $8.61. One year ago, CLF stock didn’t have a single “buy” rating.

For an in-depth review of iron ore miners’ ratings, please read Iron Ore Surge: How Are Analysts Rating the Miners?

In the next article, we’ll take a close look at the reasons for analysts’ recent revisions in 1Q17.