How Refining Stocks’ Valuations Compare to Historical Averages

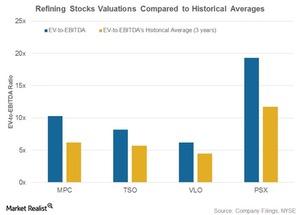

In this article, we’ll look at refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios compared to their three-year historical averages.

Nov. 20 2020, Updated 1:58 p.m. ET

Refining stocks’ valuations

In this article, we’ll look at refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios compared to their three-year historical averages.

Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading at higher valuations than their historical values. MPC, TSO, VLO, and PSX are trading at 10.3x, 8.2x, 6.2x, and 19.3x, respectively, compared to their averages of 6.2x, 5.7x, 4.5x, and 11.7x, respectively, over the past three years.

MPC, VLO, PSX, and TSO are trading at higher valuations than their historical averages due to the falls in their stock prices being lower than the falls in their earnings. This difference means that investors are holding onto these companies’ stocks despite their volatile performances.

Investors’ enthusiasm is likely the result of MPC’s taking a strategic initiative to unlock shareholder value, PSX’s ardently working on creating a diversified earnings model, and TSO’s leaping on an inorganic growth path with its ongoing acquisition of Western Refining (WNR).

For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN). The ETF has ~6% exposure to energy sector stocks such as WNR.