How Did Kimberly-Clark Perform in 2Q16?

Kimberly-Clark fell by 1.5% to close at $132.59 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -1.9%, -1.0%, and 5.6%.

July 26 2016, Published 5:01 p.m. ET

Price movement

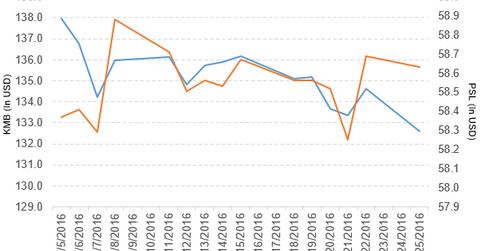

Kimberly-Clark (KMB) has a market cap of $47.8 billion. It fell by 1.5% to close at $132.59 per share on July 25, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -1.9%, -1.0%, and 5.6%, respectively, on the same day. KMB is trading 1.8% below its 20-day moving average, 0.87% above its 50-day moving average, and 4.8% above its 200-day moving average.

Related ETFs and peers

The PowerShares DWA Consumer Staples Momentum Portfolio (PSL) invests 2.0% of its holdings in Kimberly-Clark. The ETF tracks an index of US consumer cyclical firms selected and weighted by price momentum. The YTD price movement of PSL was 3.8% on July 25.

The PowerShares High Yield Equity Dividend Achievers Portfolio ETF (PEY) invests 1.7% of its holdings in Kimberly-Clark. The ETF aims to track a yield-weighted index of US companies that have increased their annual dividend for at least ten consecutive years.

The market caps of Kimberly-Clark’s competitors are as follows:

Performance of KMB in 2Q16

Kimberly-Clark reported 2Q16 net sales of ~$4.58 billion, a fall of 1.2% compared to net sales of ~$4.6 billion in 2Q15. Sales from the Personal Care, Consumer Tissue, and K-C Professional segments fell by 1.2%, 0.33%, and 1.9%, respectively, in 2Q16 over 2Q15. The company’s gross profit margin rose by 1.6% in 2Q16 over one year prior. It reported operating income of $838.0 million in 2Q16, as compared to -$544.0 million in 2Q15.

Its net income and EPS (earnings per share) rose to $566.0 million and $1.56, respectively, in 2Q16, as compared to -$305.0 million and -$0.83, respectively, in 2Q15. It reported non-GAAP (generally accepted accounting principles) EPS of $1.53 in 2Q16, a rise of 8.5% over 2Q15.

KMB’s cash and cash equivalents rose by 6.0%, and its inventories fell by 5.3% in 2Q16 compared to 4Q15. Its current ratio rose to 0.98x in 2Q16, as compared to 0.85x in 4Q15.

During 2Q16, the company repurchased 1.1 million shares worth of $150 million.

Projection

Kimberly-Clark has made the following projections for fiscal 2016:

- It expects a negative foreign currency translation on net sales and organic net sales growth at the low end of 3%–5%, which reflects lower expected benefits from selling price increases due to the improved currency outlook.

- It expects operating profits in the range of 4%–5%.

- The company expects cost savings in the range of $350 million–$400 million from its FORCE program.

- It expects EPS in the range of $5.92–$6.15 and adjusted EPS in the range of $5.95–$6.15.

- It expects a share repurchase in the range of $700–$800 million.

Now we’ll take a look at Post Holdings (POST).