How Starbucks’s Valuation Compares to Peers

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%.

April 25 2017, Updated 7:36 a.m. ET

Valuation multiple

Valuation multiples, which are driven by growth prospects, investors’ willingness to pay for a stock, and risk and uncertainties, help investors in making investment decisions.

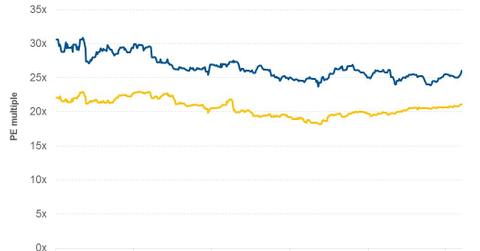

Of the various available multiples, we have selected the forward PE (price-to-earnings) multiple due to the high visibility of Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing the current stock price by EPS estimates for the next four quarters.

Starbucks’s PE multiple

The remodeling of stores, the implementation of technological innovations, and one-to-one personalized selling through its digital flywheel program appear to have increased investor confidence in Starbucks, leading to a rise in its stock price. However, due to the increase in analysts’ EPS (earnings per share) estimate for the next four quarters, Starbucks’s PE multiple remained unchanged at 26.1x compared to before the announcement of fiscal 1Q17 earnings.

In comparison, on the same day, Starbucks’s peers, Dunkin’ Brands (DNKN), Domino’s Pizza (DPZ), and McDonald’s (MCD) were trading at PE multiples of 17.2x, 32.0x, and 21.2x, respectively.

From the above graph, we can see that Starbucks’s PE multiple is trading above its peers’ median value. Starbucks’s business model allows it to expand aggressively, while its enhanced customer experience and menu innovations have helped the company in maintaining higher same-store sales growth.

Growth prospectus

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%. Starbucks’s current stock price might have factored in this EPS growth. If the company posts lower-than-expected earnings, the selling pressure could lower its valuation multiple.

You can mitigate the company-specific risks by investing in the iShares U.S. Consumer Services ETF (IYC), which invests 11.6% of its holdings in restaurants and travel companies.

Next, we’ll look at analysts’ target price and recommendations.