Where STZ’s Valuation Stands Prior to Its Fiscal 4Q16 Results

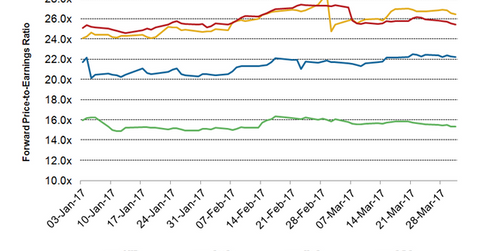

On March 31, 2017, Constellation Brands (STZ) was trading at a 12-month forward PE (price-to-earnings multiple) of 22.2x.

Nov. 20 2020, Updated 4:45 p.m. ET

12-month forward PE

On March 31, 2017, Constellation Brands (STZ) was trading at a 12-month forward PE (price-to-earnings multiple) of 22.2x. The company’s valuation multiple has risen 10.2% since the announcement of its fiscal 3Q17 results on January 5.

Constellation Brands beat analysts’ earnings expectations for fiscal 3Q17 and raised its fiscal 2017 earnings guidance.

Peer comparison

On March 31, Constellation Brands’ peers Anheuser-Busch InBev (BUD), Molson Coors Brewing (TAP), and Brown-Forman (BF.B) were trading at 12-month forward PEs of 26.5x, 15.4x, and 25.5x, respectively.

Constellation Brands’ forward PE is currently higher than that of the S&P 500 Index (SPX), which is trading at a 12-month forward PE of 18.7x. STZ is also trading at a higher valuation than the S&P 500 Consumer Staples Index with its forward PE of 21.3x.

These companies’ 12-month forward PEs differ based on several parameters, including their growth expectations, their leverage, and their risk-return profiles.

Analysts’ expectations

Analysts expect Constellation Brands’ sales to rise 11.6% to $7.3 billion and its adjusted EPS to rise 22.4% to $6.65 in fiscal 2017. Currently, analysts expect the company’s sales and adjusted EPS to rise 5.0% and 13.0%, respectively, in fiscal 2018. These estimates may be revised based on the company’s upcoming fiscal 4Q17 results and fiscal 2018 outlook.

In the current fiscal year, the adjusted EPS of Anheuser-Busch InBev, Molson Coors Brewing, and Brown-Forman are expected to rise 53.8%, 46.2%, and -1.1%, respectively.

For more updates, visit Market Realist’s Alcoholic Beverages page.