China’s Manufacturing PMI Improved: How It Could Drive Investor Sentiment

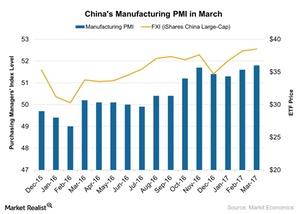

China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6.

April 17 2017, Published 11:30 a.m. ET

China’s manufacturing PMI

According to a report by the National Bureau of Statistics of China (MCHI) (FXI), China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6. The manufacturing PMI showed a stronger move in March compared to February 2017.

However, China’s (MCHI) (YINN) Caixin manufacturing PMI, which tracks small and mid-sized companies, showed some slowdown. It stood at 51.2 in March 2017 compared to 51.7 in February. It was below the market expectation of 51.5 and was in the expansion zone.

The stronger improvement in China’s manufacturing PMI compared to February was mostly due to the following factors:

- Production output slowed in March 2017 compared to February.

- Business confidence softened in March 2017.

- New export orders showed slower improvement in the same month.

- The employment growth also showed slower improvement in March 2017.

Impact on the economy

The uncertainties about trade relations between China (ASHR) and the United States (IVV) (VOO) have increased after the 2016 US presidential election. Many market participants believe that Donald Trump has a protectionist approach that could hamper the global trade relationship.

China’s policy maker is now focusing on traditional tools to stabilize the currency by maintaining a stable exchange rate. China is focusing on capital control and sterilized intervention, as the currency’s stabilization is crucial for the country. A stronger currency subdues its exports business. As a result, the currency’s stabilization is needed for the smooth functioning of its economic activity.

In the next part of this series, we’ll analyze the performance of the US non-farm payroll in March 2017.