Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

Nov. 20 2020, Updated 11:46 a.m. ET

Alcoa’s 1Q17 earnings

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day. In this part, we’ll look at key takeaways from Alcoa’s 1Q17 earnings.

Key takeaways

- Alcoa reported revenues of $2.65 billion in 1Q17. In contrast, the company posted revenues of $2.12 billion in 1Q16 and $2.53 billion in 4Q16. Although Alcoa’s 1Q17 revenues rose on a yearly and sequential basis, they fell well short of analysts’ estimates.

- Alcoa shipped 2.25 million metric tons of alumina and 801,000 metric tons of aluminum to outside customers in 1Q17. The corresponding shipments in 4Q16 were 2.27 million metric tons of alumina and 852,000 metric tons of aluminum.

- While lower shipments were a drag on Alcoa’s 1Q17 revenues, they were supported by higher average realized prices. The company reported averaged realized aluminum prices of $2,080 per metric ton in 1Q17—compared to $1,906 per metric ton in 4Q16. Alcoa’s average realized alumina prices also rose from $272 per metric ton in 4Q16 to $325 per metric ton in 1Q17.

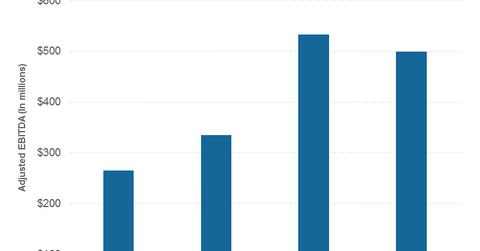

- Higher commodity prices (CENX) (NHYDY) helped drive Alcoa’s 1Q17 profitability. The company’s adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) rose to $533 million in 1Q17—compared to $315 million in the sequential quarter.

While Alcoa missed 1Q17 consensus revenues, it managed to post better-than-expected profits in the quarter. In our pre-earnings analysis, we noted that Alcoa’s 1Q17 consensus EBITDA estimates look conservative considering the steep rally in metal prices (RIO).

In the next part, we’ll look at Alcoa’s 2017 guidance.