Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

March 7 2017, Updated 10:36 a.m. ET

BNSF Railway’s carloads

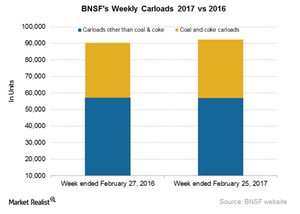

BNSF Railway (BRK-B) operates in the Western United States and competes primarily with Union Pacific (UNP). Its total railcars for the week ended February 25, 2017, rose 2.3% YoY (year-over-year) to more than 92,000 units, as compared to over 90,000 units in the corresponding week of 2016.

Carloads other than coal and coke fell slightly YoY to ~57,000 in the week ended February 25, 2017. The percentage rise in BNSF Railway’s overall carloads was less than the percentage increase reported by US railroads overall.

Why coal matters to BNSF

BNSF Railway’s coal and coke railcars rose 22.4% in the week ended February 25, 2017, on a YoY basis. This was almost equal to the rise reported by rival UNP. Coal transportation contributed nearly 22% of freight revenue in 2015 for Berkshire Hathaway’s BNSF, the largest US Class I railroad.

About 90% of this coal originates from the Powder River Basin in Wyoming and Montana. Major coal producers operating in that area include Alpha Natural Resources (ANR) and bankruptcy-declared Peabody Energy (BTU). Overall, environmental concerns and competition from natural gas (UGAZ) hampered incremental coal shipment prospects for coal producers (ARLP) in 2016.

Progressing and regressing commodity groups

The main frontrunning commodities for the week ended February 25, 2017, were as follows:

- food

- sand and gravel

- iron and steel scrap

- farm (no grain)

- motor vehicle

Commodities that witnessed backward movement included the following:

- forest products

- metallic ores

- petroleum

- waste and scrap

- non-metallic minerals

In the next part, we’ll look at BNSF Railway’s intermodal traffic.