Coeur’s Financial Leverage Improves: A Word of Caution

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015.

March 24 2017, Updated 9:06 a.m. ET

Repaying debt

Coeur Mining (CDE) ended 2016 with an outstanding debt of $210.9 million. That’s 57.0% less than at the end of 2015. Its net debt was $48.7 million at the end of 2016. The repayment of debt during the year also led to a $30.0 million annual fall in interest expenses.

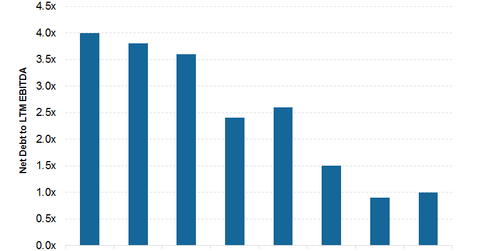

Falling financial leverage

As you can see in the above graph, Coeur Mining’s net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio was 3.8x at the end of 4Q15. It fell to less than 1.0x at the end of 4Q16, a 74.0% improvement. Lower debt and improved EBITDA led to this massive fall.

Going forward, margins could expand further if the outlook for precious metal prices remains bright and the focus remains on improving grades, enhancing recoveries, and containing costs. That could help improve its financial leverage going forward. Coeur’s liquidity position remains comfortable, with $162.0 million in cash at the end of 4Q16.

Seizing the opportunity

As a result of Coeur Mining’s balance sheet improvements, Moody’s and Standard & Poor’s upgraded their corporate and unsecured debt ratings.

In September 2016, Coeur announced a $200.0 million at-the-market stock offering in order to repay its debt.

Coeur Mining isn’t the only precious metal miner (GDX) to take advantage of rising share prices and offer equity. Kinross Gold (KGC) issued $288.0 million in equity in February 2016.

First Majestic Silver (AG) also offered equity in 2016 with the intention of using the proceeds for development and exploration activities. Iamgold (IAG) turned to equity markets with a bought deal for 38.9 million shares to raise $200.0 million.

A word of caution

After seeing Coeur’s debt reduction efforts, be sure to not lose sight of the fact that its debt is still higher than its peers and it still has high cash flow needs. As we saw earlier in this series, the company has a lot of spending plans in order to achieve its stated production growth in 2017 and beyond. That could lead to its debt creeping higher once again.