Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

March 31 2017, Published 12:20 p.m. ET

Platinum deficits

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a YTD (year-to-date) rise of only 5.8%. Although platinum is underperforming its peers, the platinum-based Physical Platinum Shares (PPLT) was posting its sixth-straight weekly gain as of March 17, 2017.

On top of that, almost $9 million was invested in the fund during the past week. Money managers are, however, reducing their net-long positions more than they have since 2006.

Meanwhile, the US dollar (UUP) continues to be one of the most important determinants of any changes in the price of precious metals. It has also played a crucial role in the fluctuation of platinum-group metals like platinum and palladium.

Gold-platinum ratio

If we compare the price performances of gold (GLD) and platinum (PPLT) using the gold-platinum ratio, we can see that the prices of gold and platinum were $1,255.3 and $954.3 per ounce, respectively, on March 29, 2017.

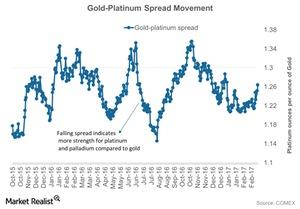

The above graph shows the performance of gold compared to platinum through the gold-platinum ratio (also referred to as the gold-platinum spread). The spread measures the number of platinum ounces it takes to buy an ounce of gold. The higher the ratio, the weaker platinum is compared to gold, because more ounces of platinum are needed to buy a single ounce of gold.

RSI levels

The gold-platinum spread was ~1.3 on March 29, 2017. The gold-platinum spread RSI (relative strength index) on that day was 65. Remember, an RSI level above 70 indicates that an asset has been overbought and could fall. An RSI below 30 indicates that an asset has been oversold and could rise.

The precious metal mining companies that have risen in the past month due to the rebound in precious metal include IamGold (IAG), Cia De Minas Buenaventura (BVN), Hecla Mining (HL), and Coeur Mining (CDE).

Now let’s move to silver.