How Merck Performed in 2016

Merck (MRK) reported growth of 1% to $39.8 billion in its 2016 revenues as compared to $39.5 billion in 2015.

March 24 2017, Updated 6:05 p.m. ET

Merck’s 2016 performance

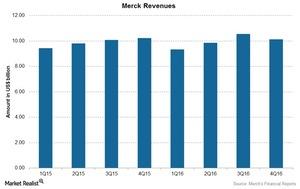

Merck (MRK) reported 2016 revenue growth of 1% to $39.8 billion as compared to $39.5 billion in 2015, which included operational growth of 3%, offset by the 2% negative impact of foreign exchange. Merck reported earnings per share (or EPS) of $3.78 for 2016. The below chart shows revenues over the last few quarters.

Revenues

Merck’s revenues saw an operational increase of 3% to $39.8 billion in 2016 as compared to $39.4 billion in 2015. On a quarterly basis, the revenues fell in three quarters of 2016, offset by growth in one quarter. The main revenue drivers were Gardasil, Keytruda, Proquad/Varivax, and animal health products. We’ll discuss the importance of these drugs to Merck in the upcoming articles.

Profitability

Merck’s gross margin improved to 75.7% during 2016 as compared to 75.4% in 2015, while the net profit margin improved to 14.3% during 2016 as compared to 11.2% during 2015. The profit margins improved following lower inventory write-offs, lower operating expenses, lower marketing and administrative expenses, partially offset by the increase in research and development expenses.

To divest company-specific risks, investors can consider ETFs like the PowerShares S&P 500 High Dividend Low Volatility ETF (SPHD), which holds 1.7% of its total assets in Merck. SPHD also holds 1.7% of its investments in AbbVie (ABBV), 1.5% of its assets in Pfizer (PFE), and 1.6% of its assets in Procter & Gamble (PG).