How to Hedge Your Portfolio against Interest Rate Risk

Investors generally look for short-term duration bonds in the midst of a rising interest rate scenario.

Dec. 11 2019, Updated 12:44 p.m. ET

Rising interest rate risks

In the present scenario, the expectation for gradual rate hikes is increasing. Thus, investors should consider hedging their portfolio against rising interest rate risk.

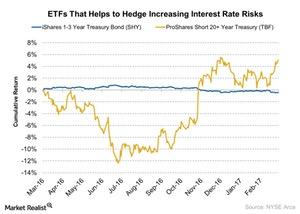

Investors generally look for short-term duration bonds during a rising interest rate scenario. Investors also look for interest-rate-hedged ETFs to hedge their portfolio against rising interest rate risk. Some short-duration-bond ETFs such as the PIMCO Enhanced Short Maturity Active ETF (MINT) and the iShares 1-3 Year Treasury Bond ETF (SHY) reduce interest rate risks.

ETFs that short bonds

Investors who want to hedge against rising interest rate risks could consider ETFs such as the ProShares Short 20+ Year Treasury ETF (TBF) and the Sit Rising Rate ETF (RISE). These ETFs short US Treasury bonds (BND). The first one provides exposure to Treasuries with a period of more than 20 years of maturity, while the second one provides exposure to Treasuries with two-year, five-year, and ten-year maturity periods.

In the next part of this series, we’ll analyze which particular sector investors should consider during a higher interest rate scenario.