Green Bonds and Conventional Bonds: What’s the Difference?

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles.

March 31 2017, Updated 3:39 p.m. ET

VanEck

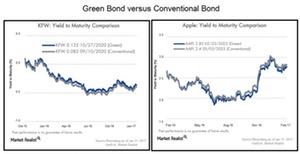

There has been anecdotal evidence of a slight “green premium,” particularly in secondary markets. When this occurs, it is likely due to the high demand for green bonds from ESG-focused investors relative to the supply available. Further, this premium may exist in certain markets, such as Europe, where there is a higher demand for green bonds rather than being a global phenomenon. To the extent that such a premium may exist, additional issuance to satisfy demand may remove any yield differential. On the other hand, if governments introduce subsidies or tax advantages, permanent pricing differentials may emerge.

Two examples are shown below comparing a green bond versus a conventional bond from the same issuer. The currency of issuance is the same, and maturities are within a few months of each other. Of course, a more analytical comparison must account for all differences between issuances, including liquidity, optionality, investor base, benchmark inclusion, and other significant differences that may exist in the bond indenture. Such analysis is beyond the scope of this simple comparison. However, what is clear is that the pricing levels of green and conventional bonds have been very close and highly correlated. Further study is recommended to determine the potential effect on bond pricing of being green, both in primary and secondary markets.

Market Realist

The difference between green bonds and conventional bonds

There isn’t much difference between a conventional bond and a green bond (GRNB), also known as a climate bond. Both have similar risk-return profiles. Green bond pricing is like any ordinary bond (BND) (AGG) (TLT) (SHY). The green label is the major difference.

A green label specifies that the proceeds will be used for environmentally related and climate mitigation projects. The added feature of a green bond is its higher credit quality and diversification benefits.

In the above graph, you can see a simple comparison of yield to maturity for conventional bonds and green bonds. The yield for both is very similar.

Green bonds have become popular with investors who take ESG (environmental, social, and governance) scores into account. As the green bond market grows and investor appetite increases, many traditional fixed income investors are considering adding a green feature to their portfolios.