What China’s Resilient Iron Ore Imports Mean for Miners

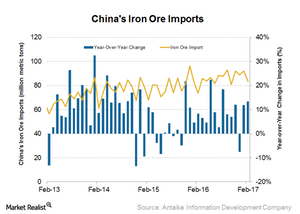

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

March 31 2017, Updated 10:36 a.m. ET

Iron ore imports remain strong

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month. This number is also a record for February. The imports for January and February have grown 12.6% YoY to 175.3 million tons.

Steel imports have been strong in China mainly due to the buoyant steel prices. Investors should also note that the strong demand is in contrast to what many market participants believe. China’s iron ore imports were also quite robust in 2016 and hit a yearly record. China’s 2016 iron ore imports came in at 1.0 billion tons, an annual rise of 7.5%.

Resilient demand

This rise was the result of two factors: resilient steel demand in China partly driven by government stimulus measures and the replacement of Chinese domestic iron ore production due to the import of cheaper high-grade ore imports mainly from Australia and Brazil.

While steel demand growth in 2017 depends on many factors such as construction sector growth and government stimulus, China’s crackdown on pollution will likely keep the replacement demand for iron ore going in 2017.

Customs data and China’s iron ore imports

China tracks its iron ore imports through customs data. This information is important for investors because it provides a good idea as to the demand for imported iron ore among Chinese mills and traders. China consumes more than two-thirds of all seaborne iron ore, so Chinese demand affects iron ore players involved in seaborne iron ore trade like Cliffs Natural Resources (CLF), Vale (VALE), and Rio Tinto (RIO).

The iShares MSCI Global Metals & Mining Producers ETF (PICK) invests in iron ore. BHP Billiton (BHP) is PICK’s top holding and it makes up 16.7% of the fund. The SPDR S&P Metals & Mining ETF (XME) also invests in some of the above stocks.

In the next part of this series, we’ll discuss what’s supporting the current trend in steel production in China.