Can Government Incentives Boost Green Bond Growth?

In order for the green bond market to expand further, government roles are vital.

Oct. 8 2020, Updated 4:56 p.m. ET

VanEck

Government incentives to boost issuance?

Despite the rapid growth seen across the green bond market, it may not be enough to meet the climate goals set out by governments globally. In addition to creating clear definitions and standards to promote market confidence and transparency, government incentives may also be needed to spur further growth. Tax advantages for investors, similar to the benefits individual investors in U.S. municipal bonds receive, may be one option governments can explore. Alternatively, direct subsidies to issuers, preferential treatment for green bonds that are held on bank balance sheets, or preferential withholding tax rates are other avenues worth exploring. A massive increase in issuance, as well as a robust secondary market and additional ways for investors to access green bonds, are essential for continued market growth.

Market Realist

What can add to further growth?

In order for the green bond market to expand further, government roles are vital. Government policies and standardizations will lead to more transparency in the green bond market and thus reduce the issuance of unlabeled bonds. The proceeds from green bonds are needed to fund and finance projects to mitigate climate-related risks.

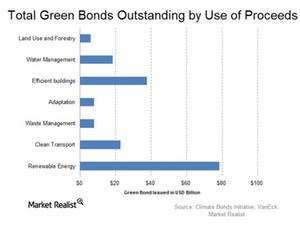

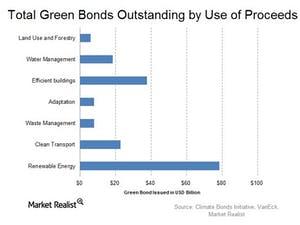

The proceeds from these bonds have been used in various environmental projects, as you can see in the above graph. Green companies earn 50%–100% of their revenues from clean technologies such as renewables (QCLN) and energy efficiency (IEO).

You can get exposure to the clean energy industry by considering the VanEck Vectors Global Alternative Energy ETF (GEX), the PowerShares WilderHill Clean Energy ETF (PBW), and the iShares Global Clean Energy (ICLN).

Some governments have gotten involved in supporting and developing the standards of the green bond market. A research paper by the OECD (Organisation for Economic Co-operation and Development) stated that in 2015, Switzerland was the first national government member of the Climate Bonds Partners to show support in the development of the Climate Bonds Standard.

José Ángel Gurría, the secretary-general of the OECD, stated in a research paper on green bonds, “Government policies can play a central role in influencing how private capital is mobilised and shifted. It will only be green if the investment landscape is supportive.”

Governments can add to the growth of the green bond market by mobilizing and making efficient use of public capital. That could lead to a faster transition to a low-carbon economy.