First Trust NASDAQ® Cln Edge® GrnEngyETF

Latest First Trust NASDAQ® Cln Edge® GrnEngyETF News and Updates

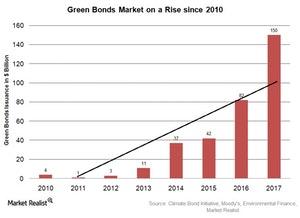

Green Bonds Issuance Show Signs of Growth in 2017

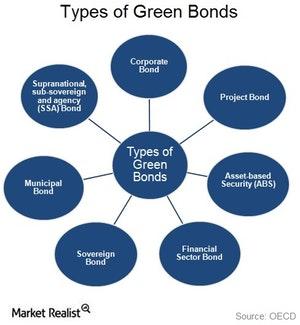

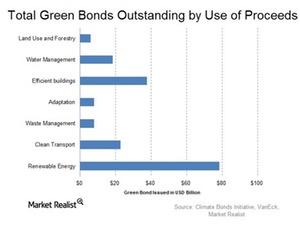

Green bonds carry the same risk-return profile as conventional bonds. However, these bonds fund projects focused on energy efficiency, clean water, transportation, biodiversity, and sustainable waste management.

The Role of Emerging Markets in Global Green Bond Issuance

Over the last ten years, the green bonds (GRNB) universe has expanded and diversified, holding 600 bonds from 24 countries in 23 currencies.

The Economic Costs That Come with Climate Goals

Climate-related policies and a transition to a low-carbon economy require capital, and most countries are already burdened with high debt.

Can Government Incentives Boost Green Bond Growth?

In order for the green bond market to expand further, government roles are vital.Macroeconomic Analysis Statoil Expects Cost Reductions in Offshore Wind

One reason that renewable energy hasn’t caught on in a big way is the cost associated with energy generation.