PowerShares WilderHill Clean Energy ETF

Latest PowerShares WilderHill Clean Energy ETF News and Updates

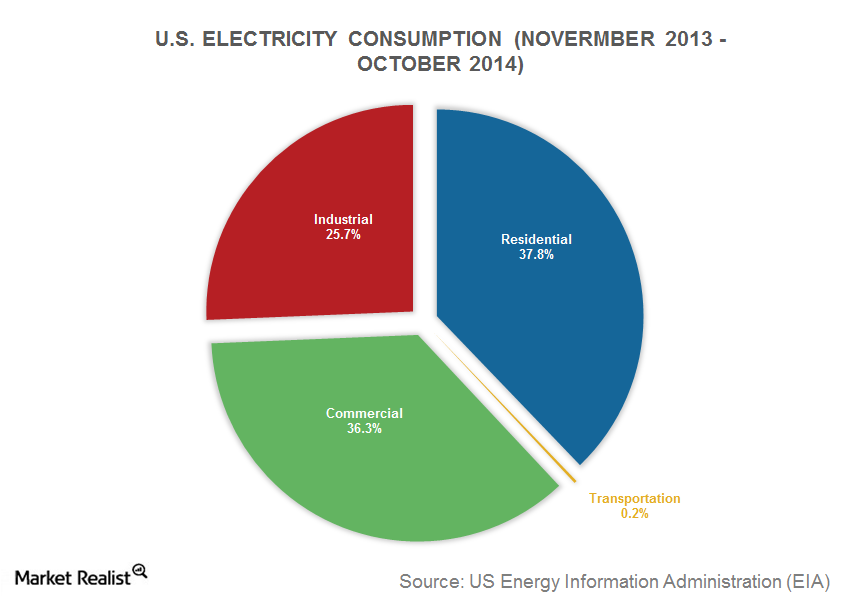

The must-know dynamics of the global power industry

In this series, we’ll look at the structure of the thermal power industry before moving on to focus on the power generation equipment sector.

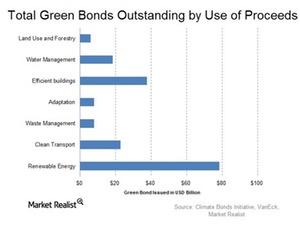

Can Government Incentives Boost Green Bond Growth?

In order for the green bond market to expand further, government roles are vital.Macroeconomic Analysis Statoil Expects Cost Reductions in Offshore Wind

One reason that renewable energy hasn’t caught on in a big way is the cost associated with energy generation.

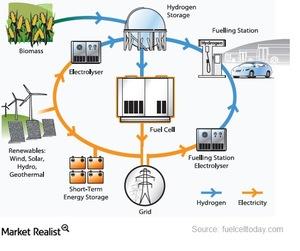

What Paris Climate Agreement Means for Fuel Cells and Solar Energy

Clean energy was one of the important issues in the Paris Climate Agreement. Fuel cells produce clean energy from a chemical reaction between anodes and cathodes.

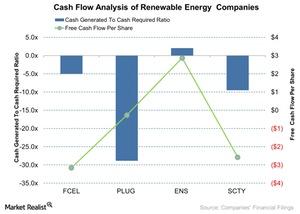

Cash Flow Analysis for Renewable Energy Companies

The cash flow is an important part of a company’s financials. Lower cash flows increase a company’s chances of being caught in a vicious cycle of debt raising and refinancing.