Are Miners Rebounding from Last Week’s Slump?

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

March 14 2017, Published 3:57 p.m. ET

Precious metal funds

Precious metals investors may also want to keep a close eye on the performances of precious metals mining stocks. Major mining funds such as the Direxion Daily Gold Miners ETF (NUGT) and the ProShares Ultra Gold ETF (AGQ) rose substantially during the start of 2017 due to the revival of precious metals. However, recently, these funds have suffered, along with mining shares.

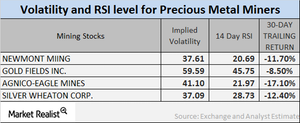

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices. In this part of the series, we’ll look at Newmont (NEM), Gold Fields (GFI), Agnico Eagle Mines (AEM), and Silver Wheaton (SLW).

Implied volatility

Call-implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than it is in a stagnant economy.

On March 13, 2017, the volatilities of Newmont, Gold Fields, Agnico Eagle, and Silver Wheaton were 37.6%, 59.6%, 41.1%, and 37.1%, respectively. The volatilities of mining companies are often higher than the volatilities of precious metals.

RSI levels

A 14-day RSI of more than 70 indicates the possibility of downward movement in a stock’s price. An RSI of below 30 indicates the possibility of upward movement in a stock’s price. The RSI levels of the four mining giants mentioned above have risen due to their rising stock prices. Most mining shares have witnessed rebounds in their prices in the past week.

Newmont, Gold Fields, Agnico Eagle, and Silver Wheaton have RSIs of 20.7, 45.8, 22, and 28.9, respectively.