Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Jan. 31 2017, Published 11:03 a.m. ET

Precious metal funds

As fluctuations in precious metals extend to funds and miners, it’s crucial to look at the fundamentals of mining companies.

Precious metal–based funds such as the leveraged ProShares Ultra Silver (AGQ) and the Direxion Daily Junior Gold Miners Bull 3X ETF (JNUG) have seen price revivals in the past month. They have 30-day trailing gains of 10.2% and 43.9%, respectively. Mining stocks often show more volatility than precious metals.

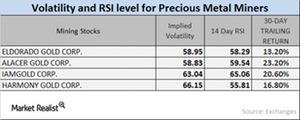

Next, let’s look at the implied volatilities of large mining stocks and their RSI (relative strength index) levels in the wake of precious metal prices. We’ll look at Silver Wheaton (SLW), Buenaventura Mining (BVN), Kinross Gold (KGC), and Eldorado Gold (EGO).

Implied volatility

The call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than in a stagnant economy.

The volatilities of Silver Wheaton, Buenaventura Mining, Kinross Gold, and Eldorado Gold were 39.7%, 49.3%, 56.6%, and 54.1%, respectively, on January 26, 2017.

RSI levels

RSI levels for each of these four mining giants rose due to their rising share prices. Silver Wheaton, Buenaventura Mining, Kinross Gold, and Eldorado Gold had RSI levels of 56.1, 52.3, 55.4, and 52.0, respectively.

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal. These four miners have 30-day trailing gains of 16.5%, 20.0%, 16.9%, and 7.4%, respectively.