Resilient Global Growth Supports Equities

OppenheimerFunds Leading indicators of the global economy are climbing and that generally bodes well for equities. Previously, we highlight the tight fit between the JP Morgan Global Composite Purchasing Managers’ Index (black line, left axis)—a leading indicator of worldwide business activity—and the year-over-year returns of the MSCI All Country World Index (ACWI) returns since 2000. […]

Feb. 24 2017, Updated 9:07 a.m. ET

OppenheimerFunds

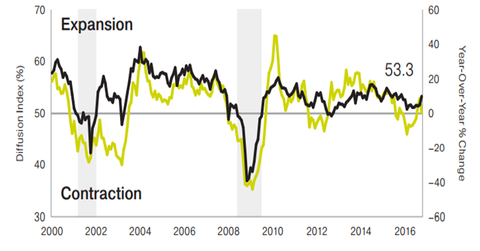

Leading indicators of the global economy are climbing and that generally bodes well for equities. Previously, we highlight the tight fit between the JP Morgan Global Composite Purchasing Managers’ Index (black line, left axis)—a leading indicator of worldwide business activity—and the year-over-year returns of the MSCI All Country World Index (ACWI) returns since 2000.

Emerging markets are enjoying a cyclical bounce led by Chinese fiscal and monetary stimulus.

The U.S. has the best growth outlook of the developed world. Consumers are well supported by good incomes, fixed investment is recovering and policy remains supportive.

Europe is a story of normalization following two recessions in eight years. The region is likely to grow at a stable clip within the range of 1.5%–1.7%. There is pent-up demand in the economy and credit is finally picking up. Monetary and fiscal policy are both supportive.

The Japanese economy remains mired in mediocrity. The economy is poised to expand by 0.5% in 2017, which is essentially trend growth for the country. The psychology of deflation is not changing. Policy will continue to remain dovish.

Equity valuations, particularly in the developed world, are extended compared with historical averages and are at levels historically consistent with more modest returns. However, valuations at these levels can be rationalized, given the current interest rate and inflation environment, as well as modest global economic activity.

Developed Markets: We continue to favor U.S. equities, as the United States has the best growth outlook of any large, developed economy; earnings growth is recovering; and the country has the potential for the biggest positive policy surprise given current expectations.

Emerging Markets: Emerging market equities are trading at a slight premium to their historical averages but at a discount to developed market equities. We held an optimistic view for much of 2016 but currently maintain a more neutral stance. Emerging markets may suffer from outflows as investors attempt to parse potential protectionist policies of the Trump administration. Ultimately, a global reflation trade should be supportive of commodity prices and emerging market asset prices in general.

Market Realist

The above graph shows Japan’s GDP (EWJ) growth rate along with its YoY (year-over-year) CPI (consumer price index) inflation rate and YoY export growth rate. Japan’s economy has been in a rut for more than two decades.

Abenomics has not affected Japan’s economy to a great extent, and a dovish monetary policy has not yielded much yet. The consumption tax was boosted to 8.0% from 5.0% in April 2014 in a move aimed at improving government finances. But this took the wind out of the sails of the economy as consumption suffered.

A stronger yen over the last few quarters has also negatively affected the country’s exports, further burdening the economy. An aging population is squeezing the size of the workforce.

In the United States (RWL) (RWJ), a comparatively solid growth compared to other developed markets is likely to support U.S. stocks (RDIV) (RWK). While valuations remain pretty high, earnings are improving, and the proposed corporate tax cut would serve as a tailwind. That said, U.S. markets are likely to yield only in the mid-single digits this year, at best, as multiple rate hikes are a threat.

Disclosures

Mutual funds are subject to market risk and volatility. Shares may gain or lose value.

Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes, regulatory and geopolitical risks. Bonds are exposed to credit and interest rate risks (when interest rates rise, bond/fund prices generally fall). Senior loans are typically lower rated and may be illiquid investments (which may not have a ready market). Value investing involves the risk that undervalued securities may not appreciate as anticipated.

These views represent the opinions of OppenheimerFunds, Inc. and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the publication date, and are subject to change based on subsequent developments.

Carefully consider fund investment objectives, risks, charges, and expenses. Visit oppenheimerfunds.com or call your advisor for a prospectus with this and other fund information. Read it carefully before investing.

OppenheimerFunds is not affiliated with Market Realist.

©2017 OppenheimerFunds Distributor, Inc.