OppenheimerFunds

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From OppenheimerFunds

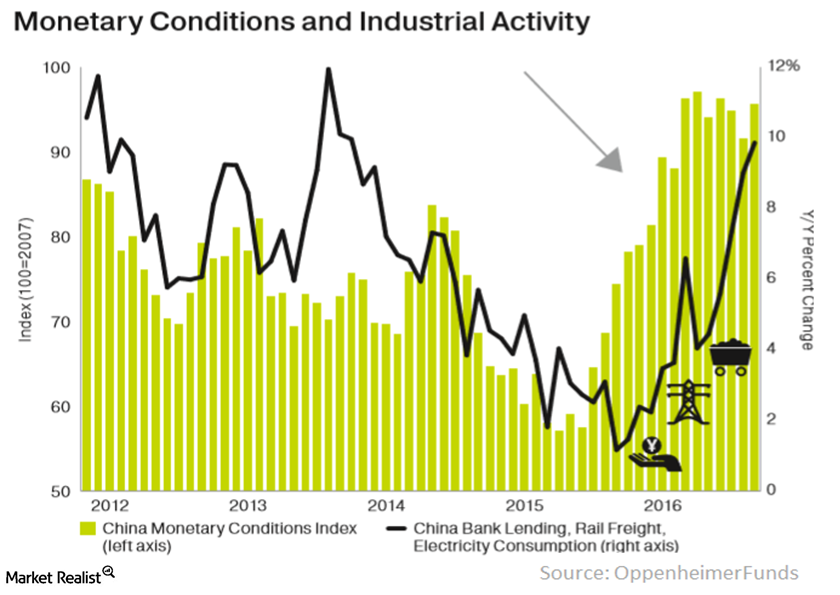

China Is Stabilizing through Policy Support

OppenheimerFunds Make no mistake, China is a controlled economy where growth can still be manufactured at will. Massive fiscal and monetary stimulus has China going through a “mini” boom with the pace of economic growth stronger and more broad based than what the markets expected. And as China goes, so goes the rest of emerging […]

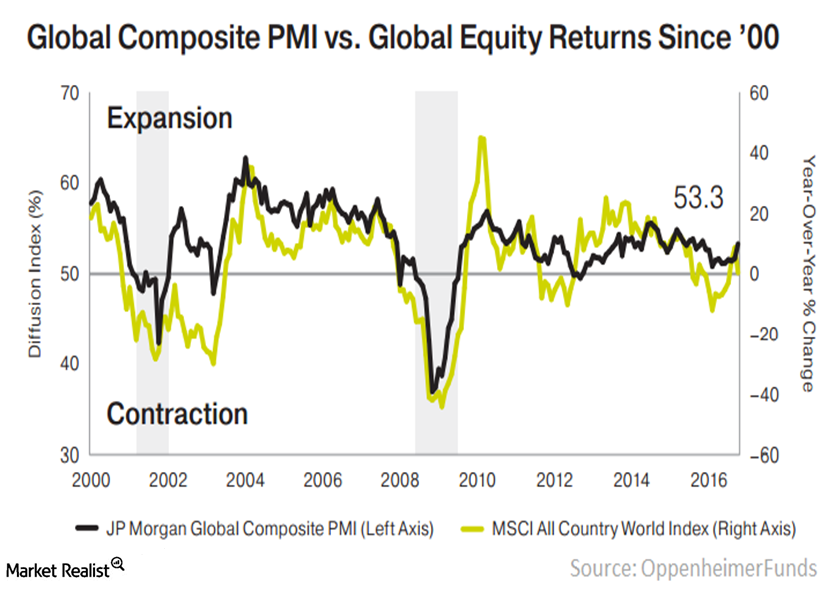

Resilient Global Growth Supports Equities

OppenheimerFunds Leading indicators of the global economy are climbing and that generally bodes well for equities. Previously, we highlight the tight fit between the JP Morgan Global Composite Purchasing Managers’ Index (black line, left axis)—a leading indicator of worldwide business activity—and the year-over-year returns of the MSCI All Country World Index (ACWI) returns since 2000. […]

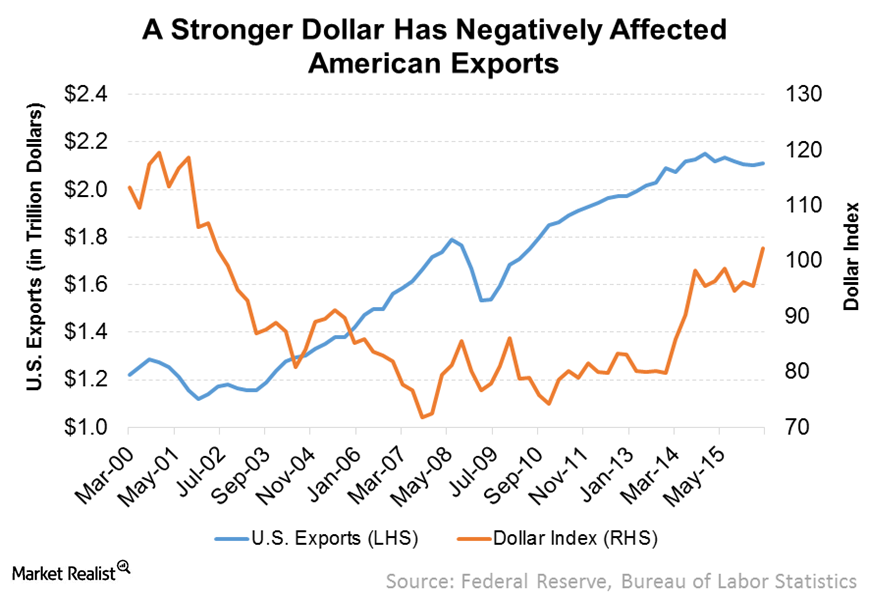

We Are in a New World of Persistent Dollar Strength

OppenheimerFunds That was then: For the longest time, we insisted that the strength of the dollar was the equalizer in a deleveraging world. If the Fed were to be the only major country in the world raising interest rates, then the dollar would appreciate significantly. Dollar strength would prove to be a headwind to U.S. […]

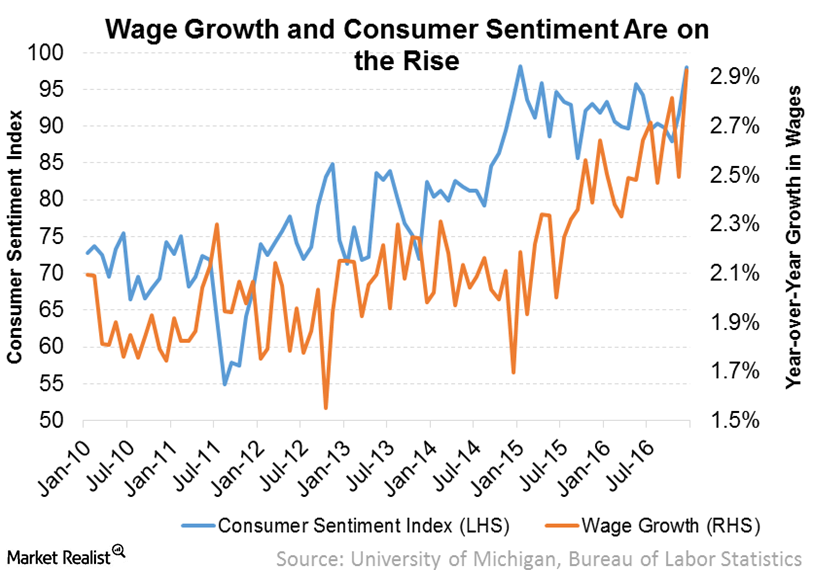

U.S. Economic Drag Is Fading, Upside Surprises Are Possible

OppenheimerFunds The U.S. economy was weaker than expected in 2016, the lagged effect of the Fed’s policy mistake in 2015. In our opinion, the worst is now over for the United States, and economic growth should improve in 2017 and could even surprise to the upside with an appropriate fiscal policy mix from the new […]

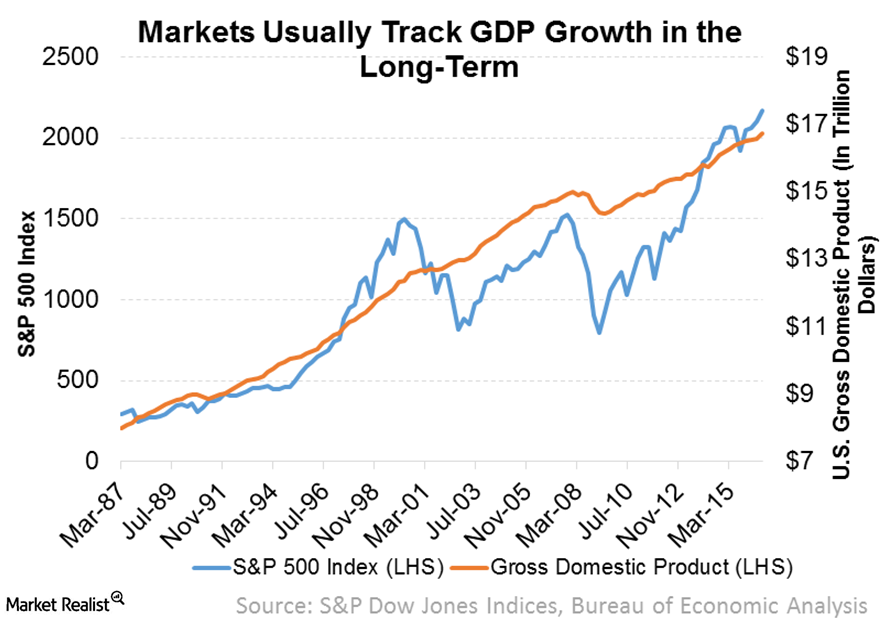

The Cycle Continues, but the Risks Are Rising

OppenheimerFunds In response to accusations of flip-flopping, John Maynard Keynes purportedly quipped, “When the facts change, I change my mind. What do you do, sir?” With 2017 in full swing, the facts have changed. Since the financial crisis, the global economy has been mired in a slow growth, disinflationary world. We argued that the weak […]