Novartis’s Innovative Medicines Segment in 4Q16

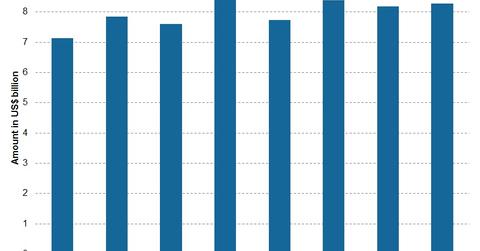

The overall contribution from NVS’s Innovative Medicines segment was ~67%, reaching $8.3 billion in 4Q16.

Feb. 1 2017, Updated 4:35 p.m. ET

NVS’s Innovative Medicines segment

Novartis’s (NVS) Innovative Medicines segment consists of products for therapeutic areas including oncology, cardio-metabolic, immunology and dermatology, retina, respiratory, neuroscience, and established medicines. The overall contribution from the Innovative Medicines segment was ~67%, reaching $8.3 billion in 4Q16.

The segment includes the pharmaceuticals and oncology businesses. In fiscal 2016, the segment reported revenues of $32.6 billion, which was a 2% fall from the $33.3 billion in 2015, due to the negative impact of foreign exchange.

Performance of key innovative products

Growth products including Gilenya, Tasigna, Galvus, a combination of Mekinist and Tafinlar, Promacta and Revolade, Jakavi, Entresto, and Cosentyx reported a 20% rise in revenues at constant currencies to $4 billion for 4Q16, or nearly 48% of total segment sales for the quarter.

Gilenya (fingolimod) is an oral therapy for multiple sclerosis. Due to increased demand, its revenues increased by 11% at constant exchange rates, reaching $810 million in 4Q16, as compared to $742 million in 4Q15.

Gilenya reported double-digit growth in most markets. Gilenya competes with Biogen’s (BIIB) Tecfidera (dimethyl fumarate) and Sanofi’s (SNY) Aubagio (teriflunomide).

Tasigna, Tafinlar, and Mekinist

Tasigna (nilotinib), a drug for the treatment of chronic myeloid leukemia, reported a 9% rise in revenues at constant exchange rates, reaching $458 million in 4Q16, following 5% growth in the global markets, and 16% growth in the US markets. Tasigna competes with Pfizer’s (PFE) Bosulif (bosutinib).

Tafinlar (dabrafenib) and Mekinist (trametinib) combination are used in the treatment of BRAF V600+ metastatic melanoma. The combination is approved in over 60 countries for the treatment of unresectable melanoma, and 35 countries for the treatment of metastatic melanoma. The combination reported a growth of 24% at constant exchange rates, reaching $178 million in 4Q16.

To divest risk, investors can consider ETFs like the PowerShares International Dividend Achievers ETF (PID), which has 1.1% of its total assets in Novartis.