We Are in a New World of Persistent Dollar Strength

OppenheimerFunds That was then: For the longest time, we insisted that the strength of the dollar was the equalizer in a deleveraging world. If the Fed were to be the only major country in the world raising interest rates, then the dollar would appreciate significantly. Dollar strength would prove to be a headwind to U.S. […]

Feb. 23 2017, Updated 12:35 p.m. ET

OppenheimerFunds

That was then:

For the longest time, we insisted that the strength of the dollar was the equalizer in a deleveraging world. If the Fed were to be the only major country in the world raising interest rates, then the dollar would appreciate significantly. Dollar strength would prove to be a headwind to U.S. exports and corporate profitability. Consumption and investment would also have to be lower as the U.S. economy struggled to absorb the strength of the dollar at a time when credit creation wasn’t growing fast enough. We applauded Janet Yellen and the FOMC when they backed off of their tightening stance in pursuit of a “high-pressure economy” in which inflation would run hot in order to promote greater labor force participation and higher wages.

This is now:

The arrival of a Trump presidency suggests that dollar strength and U.S. growth are no longer mutually exclusive. If the U.S. federal deficit widens on a persistent basis as the Trump team is indicating, then those foreign savings can be absorbed by federal borrowing, and the U.S. growth rate can be higher even with the strength of the dollar. In all likelihood, we should expect persistent dollar strength. If economic growth resulting from fiscal stimulus is consistent then there will be no issues. Here’s the rub: The U.S. trade deficit will widen as a result, and the country will end up exporting a significant amount of its fiscal-induced stimulus to other parts of the world. For a Trump administration that won on an anti-trade and anti-deficit widening agenda, this could create protests from Trump supporters. And the rhetoric of trade wars and currency controls would only get hotter.

Market Realist

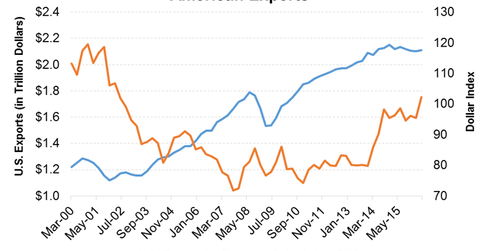

The above graph compares U.S. exports with the dollar index (UUP) over the long term. U.S. exports have historically had a negative correlation with the U.S. dollar, as the graph shows. A stronger dollar makes American goods less attractive to overseas buyers, which negatively affects export growth. That’s been the case in the last 30 months or so, as persistent dollar strength has been a drag on exports and, in turn, the economy (RWL) (RWJ).

Higher government spending and tax cuts could lead to a fiscal deficit, which could weaken the dollar. At the same time, U.S. bond yields could remain attractive compared to other developed market bonds, pulling more funds to the United States and strengthening the dollar.

Robust economic (RDIV) (RWK) growth caused by aggressive spending and tax cuts would also strengthen the dollar, as it would attract more foreign funds.

Bottom line: A stronger dollar is probably here to stay.