Priceline’s String of Acquisitions Continues with Momondo

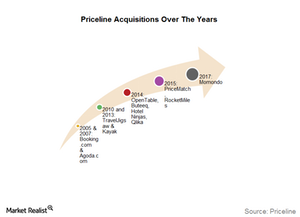

Earlier this month, the Priceline Group (PCLN) signed a deal to acquire Momondo Group. Priceline will acquire all outstanding shares of Momondo for $550 million in an all-cash deal.

Feb. 27 2017, Updated 7:38 a.m. ET

Momondo acquisition

Earlier this month, the Priceline Group (PCLN) signed a deal to acquire Momondo Group. Priceline will acquire all outstanding shares of Momondo for $550 million in an all-cash deal. The acquisition is subject to regulatory approval and is expected to close later this year. The newly acquired company would be combined under Priceline’s leading metasearch brand Kayak.

Momondo’s business model

Momondo Group was created in 2011 when the UK-based Cheapflights Media acquired Denmark-Momondo. Since then, it has followed a dual-brand strategy that had never been used before.

Before acquiring Momondo, Cheapflights gave customers only negotiated price deals. After the acquisition, it became a metasearch site. This means that instead of viewing only one deal from one site at a time, customers can compare fares from different websites at the same time.

When it was launched in 2006, Momondo was only a flight search engine. It slowly increased its offerings to include price comparisons for hotels, cars, and vacation packages.

Currently, the Momondo Group offers price comparisons for hotels, flights, and cars, while the Cheapflight brand offers flight price comparisons and travel deals.

Series overview

In this series, we’ll look at Priceline’s reasons for acquiring Momondo, what it means for Priceline’s business, and how it could change the dynamics of the online travel industry.

Investors can gain exposure to Priceline by investing in the iShares US Consumer Services ETF (IYC), which invests 2.6% of its holdings in Priceline. It also holds 0.40% in Expedia (EXPE) and 0.18% in TripAdvisor (TRIP). It has no holdings in Ctrip (CTRP).