How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

Feb. 3 2017, Updated 9:07 a.m. ET

Mining companies regained

Donald Trump’s recent victory in the US presidential election on November 8, 2016, initially resulted in fear among precious metal investors. As these concerns subsided, precious metals and mining stocks slowly started falling. The rate hike phenomenon in December 2016 also played negatively for precious metals, and precious metals and their mining companies kept falling.

Some investors expected choppy markets for precious metal mining companies after Trump’s victory, but that didn’t happen. Miners are often known to follow precious metals. Most of the time, they move in the same direction.

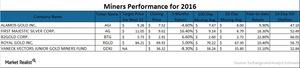

On a YTD (year-to-date) basis, Newmont Mining (NEM), Gold Fileds (GFI), Agnico-Eagle Mines (AEM), Primero Mining (PPP) rose 0.9%, 13.1%, and 7.8%, respectively. Primero Mining (PPP), however, has seen a YTD loss of 3.9%. The VanEck Vectors Junior Gold Miners ETF (GDXJ) saw a YTD rise of 15.1%.

Technical indicators

The above four mining companies are trading close to their 100-day moving averages. However, they’re above their shorter-term, 20-day moving averages. Alamos is the only stock that’s below its 20-day moving average.

A substantial premium on a stock’s trading price suggests a potential fall in prices. A discount could indicate a rise in prices. Target prices for the above four mining companies are significantly higher than their current prices, which suggests a positive outlook.

An RSI (relative strength index) level above 70 indicates that a stock has been overbought and could fall, while an RSI level below 30 indicates that a stock has been oversold and could rise. Mining companies’ RSI readings are also slowly rising.

As of January 26, 2017, GDXJ’s RSI level was close to 52.8.The rate hike phenomenon in December 2016 also played negatively for precious metals,