What Drove Crestwood Equity Partners’s 4Q16 EBITDA Growth?

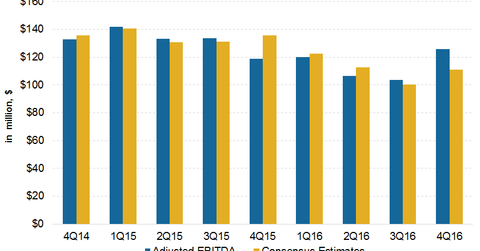

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Its 4Q16 adjusted EBITDA increased to $125.6 million from $118.9 million in 4Q15, a year-over-year increase of 5.6%.

Feb. 23 2017, Updated 8:08 a.m. ET

Crestwood Equity’s 4Q16 EBITDA

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Crestwood Equity Partners’s 4Q16 adjusted EBITDA[1. earnings before interest, taxes, depreciation, and amortization] increased to $125.6 million from $118.9 million in 4Q15, a YoY (year-over-year) increase of 5.6%.

The partnership beat its 4Q16 EBITDA estimate by 13.3%. Crestwood Equity Partners met its 2016 EBITDA guidance of $435 million–$465 million by reporting 2016 adjusted EBITDA of $455.6 million. However, its 2017 outlook is weak.

Crestwood Equity Partners’s 4Q16 EBITDA drivers

Crestwood Equity Partners’s YoY increase in 4Q16 EBITDA was driven by:

- Gathering and Processing: The segment posted a $53.7 million increase in EBITDA, mainly due to what the company stated was a “$51.4 million equity investment impairment” in 4Q15. The segment saw lower throughput volumes in 4Q16 compared to 4Q15. We’ll look more into this in the next article.

- Storage and Transportation: The Storage and Transportation segment’s adjusted EBITDA increased 13.7% despite the negative impact of Stagecoach JV. CEQP received a 35% share of earnings from the joint venture. The company noted that the segment benefited from $14.3 million of “deficiency payments at the COLT Hub.”

- Marketing, Supply, and Logistics: The segment’s performance was negatively impacted by lower trucking volumes. This was partially offset by higher NGLs (natural gas liquids) volumes due to lower winter temperatures in 4Q16 compared to 4Q15. DCP Midstream LP (DPM) and Enable Midstream Partners (ENBL) are among the midstream companies that benefit from cold winters.

CEQP’s distributable cash flows

Crestwood Equity Partners’s 4Q16 distributable cash flow increased 8.2% quarter-over-quarter, resulting in a slight improvement in its distribution coverage ratio. CEQP ended 4Q16 with a distribution coverage of 1.9x.