China Is Stabilizing through Policy Support

OppenheimerFunds Make no mistake, China is a controlled economy where growth can still be manufactured at will. Massive fiscal and monetary stimulus has China going through a “mini” boom with the pace of economic growth stronger and more broad based than what the markets expected. And as China goes, so goes the rest of emerging […]

Feb. 27 2017, Updated 3:58 p.m. ET

OppenheimerFunds

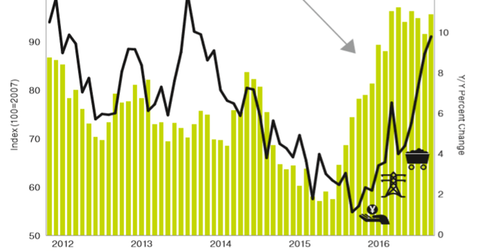

Make no mistake, China is a controlled economy where growth can still be manufactured at will. Massive fiscal and monetary stimulus has China going through a “mini” boom with the pace of economic growth stronger and more broad based than what the markets expected. And as China goes, so goes the rest of emerging markets and commodity prices, at least for the first two quarters of 2017.

Don’t confuse a policy-driven cyclical rebound for a change in the long-term outlook. The secular issues in China of high savings rates, capital misallocation, and increasing debt loads are still intact. And these issues will assert themselves once the growth outlook starts fading in the second half of the year. Importantly, China’s debt problems are unlikely to be resolved with a massive credit crisis. The way the debt problem gets resolved over the long term is by the Chinese economy growing at a much more modest pace as the adjustment process from a manufacturing-based to a service/consumer-based economy continues.

Market Realist

China’s (FXI) economy grew 6.8% in the fourth quarter of 2016, boosted by higher government spending and bank lending. It was the first time in two years that the Chinese economy has shown an uptick in GDP growth.

However, China’s debt-to-GDP ratio rose to a whopping 277% at the end of 2016 from 254% the previous year. That could be a severe strain on the economy in the coming years. Also, it faces more pressure to cool its overheated housing market.

Another risk to the economy is the possibility of faster-than-expected U.S. (RWL) (RWJ) interest rate hikes. That could cause higher capital outflows and further stress China’s financial system.

The country’s exports could suffer another setback if U.S. (RWK) (RDIV) President Trump goes ahead with his proposed protectionist measures.

A hard landing of the Chinese economy could have a big impact on commodities and most emerging markets as it did in late 2015 and early 2016.