This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

Nov. 20 2020, Updated 1:54 p.m. ET

Iron ore costs

Iron ore makes up 38% of BHP Billiton’s (BHP) (BBL) revenues and 42% of its EBITDA (earnings before interest, tax, depreciation, and amortization). So it’s important to look at its iron ore costs, which determine its iron ore segment’s profitability. This ultimately impacts its stock price and relative performance.

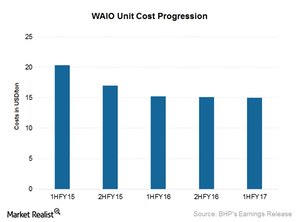

Cost-cutting in iron ore

More than 90% of BHP’s iron ore comes from WAIO (Western Australia iron ore). The production of WAIO increased by 4% to record 136 million tons in the first half of 2017, mainly due to the Jimblebar mine operating at full capacity and improved rail track reliability.

Below are a few specifics to consider:

- The unit costs for BHP’s WAIO fell 1% to $15.05 per ton in the first half of 2017.

- Cost reduction was driven by lower labor and contractor costs and inventory stock buildup.

- The improvements in costs were partially offset by stronger Australian dollar, stock write-off at Yandi, and additional costs related to the rail renewal and maintenance program.

- Increased volumes, prices, and lower costs led to an EBITDA margin of 60.5%, as compared to a margin of 53% in the same period last year.

Unit cost guidance

For fiscal 2017, BHP management expects its unit costs for WAIO to be less than $15 per ton. Previously, the company expected costs to be $14 per ton. The revised guidance is due to unfavorable exchange rate movements.

While BHP has improved its unit costs, it is still higher than its major peers. Rio Tinto (RIO) had a unit cost of $13.7 per ton for its Pilbara operations. Vale (VALE) also has lower C1 cash costs as compared to BHP. Cliffs Natural Resources (CLF) also reduced its production costs in the United States due to headcount reduction and other input costs.

During the call

The company’s management mentioned that they had $1 per ton of one-off costs in fiscal 1H17. It also said that while C1 cash costs are higher than some of its peers, it has remained “the market leader” in total cost delivered to China.

The company’s CEO, Andrew Mackenzie, also added that they, “would intend to hold on to or increase that advantage while closing the gap in the way we’ve done, in a number of ways.”

In a commoditized space such as iron ore mining, miners can’t control prices. Controlling costs in such a scenario could be a key differentiator between companies and could lead to a stock price performance divergence.

BHP Billiton, Rio Tinto, and Vale make up 32.1% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). The SPDR S&P Metals and Mining ETF (XME) also provides exposure to this space.