Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

Feb. 22 2017, Published 3:27 p.m. ET

Mining stocks and gold

It’s important to understand which mining stocks have overperformed and which have underperformed precious metals. Precious metals prices have risen due to uncertainty since President Donald Trump took office in the United States. The buoyancy of precious metals could further be challenged by future interest rate hikes, which could also cause mining stocks to fall.

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP). These companies rose significantly in 2016, and they’ve seen strong starts in 2017. While mining companies often amplify the returns of precious metals, they’ve had mixed performances in the past week.

Correlation trends

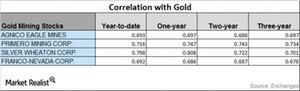

While all of the above-mentioned stocks are closely related to precious metals, Primero Mining and Royal Gold have the highest correlations with gold YTD among the miners under discussion. B2Gold is the least correlated with gold.

Over the past three years, Primero Mining has seen an upward-trending correlation with gold. The correlations of Agnico Eagle Mines and Royal Gold have seen upward and downward correlations. B2Gold has seen a downward trend in its correlation.

Primero Mining’s correlation has risen from a ~0.73 three-year correlation to a ~0.75 one-year correlation. With a correlation of ~0.75, it can be said that about 75% of the time, Silver Wheaton has moved in the same direction as gold in the last year. Usually, a fall in gold leads to falls in mining stocks, and vice versa.

Some ETFs that have high correlations with precious metals include the Physical Swiss Gold Shares ETF (SGOL) and the Physical Silver Shares ETF (SIVR).