ADI’s Plan for a High Gross Margin in Slow Quarters

Analog Devices’ fiscal 1Q17 revenues will likely see seasonal declines, and this seasonality is something that it can’t escape.

Dec. 4 2020, Updated 10:53 a.m. ET

ADI’s gross margin

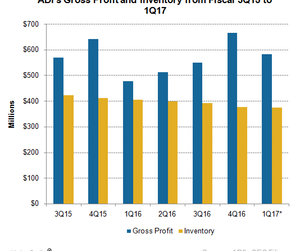

Analog Devices’ (ADI) fiscal 1Q17 revenue will likely be hit by seasonal declines, and this seasonality is something that the company cannot escape. For this reason, the company has reduced its inventory and improved its cost efficiency and pricing to maintain its gross margin even during low times.

ADI’s non-GAAP (generally accepted accounting principles) gross margin fell from 65.7% in fiscal 4Q15 to 62.7% in fiscal 1Q16 as the seasonal revenue decline was higher than the decline in inventory. While revenue fell 21.4% sequentially, inventory fell 17% in fiscal 1Q16. Notably, ADI’s key customer, Apple (AAPL), reported its first decline in iPhone sales during the same period.

However, ADI does not expect Apple’s orders to decline significantly in fiscal 1Q17. Even if there are declines in Apple’s orders, ADI is well-prepared to withstand this headwind.

Inventory management

Industry data has shown that the demand for high-end smartphones is slowing and is unlikely to return to its past growth, and so ADI has started adjusting its inventory accordingly. In fiscal 2016, the company reduced its inventory by $35 million, or 8.5%, to $377 million in fiscal 4Q16. This reduced the company’s days of inventory by nine days to 105 days.

The reduced inventory has increased ADI’s capacity to sustain lower factory utilization during seasonally weak quarters.

Gross margin estimate

For fiscal 1Q17, ADI expects to maintain its gross margin between 65.5% and 66%, which is 60 basis points lower than the 66.6% margin reported in fiscal 4Q16. However, this fall is lower than the 300-basis-point decline in fiscal 1Q16. Although the gross margin would decline slightly, gross profit in dollar terms may fall 12% sequentially to $583.75 million in fiscal 1Q17.

The company expects to maintain its factory utilization at the fiscal 4Q16 level of above 65% in fiscal 1Q17.

What factors drive ADI gross margin?

While factory utilization is one of the key factors driving gross margin, product mix and pricing are other factors that improve ADI’s gross margin. At the fiscal 4Q16 earnings call, ADI CFO (chief financial officer) Dave Zinsner mentioned that the company’s ASP (average selling price) has increased by probably 30% to 40% over the past four years, which has had a significant impact on the company’s gross margin.

On the product mix front, a major portion of ADI’s fiscal 4Q16 inventory was in portable consumer applications shipped to Apple during the quarter. However, for fiscal 1Q17, product mix is unlikely to be a major factor governing gross margin as all the four segments are likely to report revenue declines.

Next, we’ll look at ADI’s operating profits.