Will the Shari’ah Standard on Gold Be a Game-Changer?

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry.

Jan. 18 2017, Updated 10:37 a.m. ET

VanEck

On December 5, a second potentially favorable development for gold occurred when the Shari’ah Standard on Gold (the “Standard”) was released by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).5 The Standard, for the first time, sets out specific rules for the use of gold as an investment in the Islamic finance industry. Until now, there have been no such rules and this has led to confusion over whether or not Islamic households are permitted to invest in gold. Those who wanted to own gold were compelled to invest only in jewelry. The Standard also rules that it is permissible to invest in gold mining stocks. This opens a significant segment of the global population that already has an affinity for gold to initiate potential investments in gold bars, coins, ETPs, and stocks.

Market Realist

Sharia-compliant gold investment standards

In December, the AAOIFI and the WGC (World Gold Council) issued, for the first time, Shari’ah standard to deal with the use of gold (GDX) (GDXJ) as an investment in the Islamic finance industry. Previously, Islamic finance had no rules related to gold investment. As a result, uncertainty prevailed over the Islamic way of investing in gold, hindering the development of the gold (SGOL) market. However, the new standard has opened up gold as an investment asset class in the Muslim world, which could generate more demand for gold.

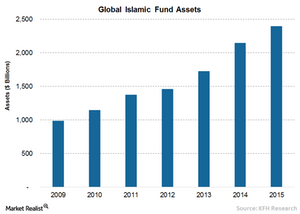

Large potential

The current market size of the Islamic finance industry is ~$2 trillion while Standard & Poor projects the industry to grow to $3 trillion in the next decade. The new standards could lead to a huge flow of money from the Muslim world into the gold market over the next few years. According to Natalie Dempster, the WGC’s Managing Director of Central Banks and Public Policy, “If just 1% of Islamic assets were to go into gold in the next five years that would be equivalent to 500 tons of gold.” To put it in perspective, gold (IAU) (GLD) demand amounted to 993 tons in 3Q16, showed the latest data from the WGC. In short, the Islamic finance industry has the ability to generate additional demand worth roughly 50% of the existing demand.

New product launches

The clarity provided by new standards are likely to boost the development of financial products based on precious metals. After the announcement, some companies have begun to initiate new product launches. The Singapore Exchange launched its first Sharia’ah-compliant gold futures contract, designed according to requirements of Islamic finance. Shari’ah-compliant exchange-traded funds are also likely to launch in the next few quarters.

5The Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) is the recognized world leader in Islamic finance standards, and its rulings are widely accepted across the majority of Islamic markets.