What Could Drive Amgen’s Growth in 2017?

Enbrel, Neulasta, and Epogen are among Amgen’s (AMGN) major revenue-generating drugs, each with annual sales in excess of $1 billion. Enbrel and Neulasta together accounted for ~46% of Amgen’s 2016 revenues.

May 23 2017, Published 12:56 p.m. ET

Major revenue-generating drugs

Enbrel, Neulasta, Aranesp, Prolia, Sensipar, Xgeva, and Epogen are the major revenue-generating drugs for Amgen (AMGN). Each of these drugs has annual sales in excess of $1 billion.

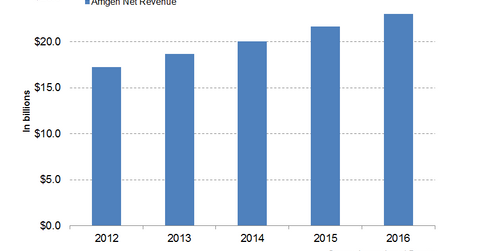

Enbrel and Neulasta together accounted for ~46% of Amgen’s 2016 revenues. The chart below depicts Amgen’s revenue growth over the last five years.

Repatha

According to estimates by the American Heart Association, the treatment of cardiovascular disease in the US incurred an ~$555 billion cost in 2016. This statistic underlines the significant cost burden posed by this disease.

Repatha’s superior clinical efficacy data could have the potential to propel the drug’s revenues in 2017. In 1Q17, Repatha generated sales of $49 million, which represents 26% year-over-year sales growth.

If access constraints are removed, Repatha can present a solid growth opportunity for Amgen in 2017. However, the drug faces stiff competition from Regeneron Pharmaceuticals (REGN) and Sanofi’s (SNY) Praluent.

Kyprolis

Amgen’s proteasome inhibitor, Kyprolis, generated revenues close to $190 million in 1Q17, witnessing 23% year-over-year growth. Presently, the company is focusing on commercialization of Kyprolis in international markets. If the company can successfully implement its strategy for international markets, the drug’s revenues could witness rapid growth in 2017.

Sensipar

In 1Q17, Sensipar generated revenues of $421 million, which represented 15% year-over-year growth. The sales growth for Sensipar was primarily driven by volume growth and increases in its net selling price.

Factors driving Amgen’s 2017 revenue growth

Amgen is working with payers to reduce reimbursement constraints for its newly launched products. The clinical efficacy of recently launched drugs such as Repatha and Kyprolis over their peers is expected to favor the reimbursement scenario. The success in improving access is believed to fuel Amgen’s revenue growth in 2017.

Amgen is also seeking regulatory approval from the FDA for Xgeva as a treatment option for preventing skeletal-related events (or SREs) in multiple myeloma patients. If this application is approved, it could significantly boost the drug’s sales.

Amgen’s collaboration with Dr. Reddy’s Laboratories (RDY) for the commercialization of Amgen’s oncology drugs may propel the company’s revenue growth. Amgen’s success in the global market may fuel share prices of the iShares NASDAQ Biotechnology ETF (IBB). Amgen makes up ~7.5% of IBB’s total portfolio holdings.

In the next article, we’ll discuss Amgen’s PCSK9 inhibitor drug, Repatha.