Why Most Wall Street Analysts Recommend a ‘Hold’ for IFF

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions.

Aug. 18 2017, Updated 11:35 a.m. ET

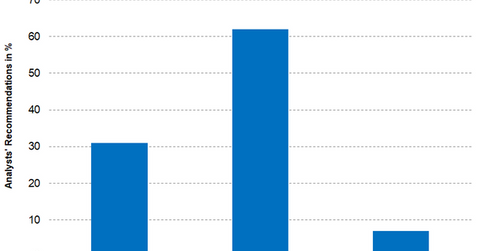

Analysts’ consensus on IFF

The number of analysts covering International Flavors and Fragrances (IFF) has gone up from 15 to 16 in the last two months. Of the 16 analysts, 31% of the analysts have recommended the stock as a “buy,” 62% of the analysts have recommended the stock as a “hold,” while the remaining 5% of the analysts have given a “sell” recommendation for IFF.

In the past two months, the analysts’ consensus 12-month mean target price for IFF has moved up from $137.15 to $142.42 currently, which implies a potential return of 5.3% from the closing price of $135.28 on August 17, 2017.

Why analysts recommend a “hold”

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions. The company has acquired three companies in the past nine months. Further, to drive its organic growth, IFF has opened a new company, Tastepoint, to tap middle-market North American customers. Also, IFF’s better-than-expected 2Q17 earnings could have prompted analysts to recommend a “hold” for IFF.

Target prices from individual brokerage firms

- J.P. Morgan (JPM) has given a price target of $133 for IFF. However, as of August 17’s closing price, the stock was 1.7% above the recommended target price.

- Deutsche Bank (DB) recommends a target price of $139 for IFF, implying a potential return of 2.8% from its August 17, 2017, closing price of $135.28.

- Stifel has raised its target price on IFF to $136 as against the earlier recommended price of $129. The new target price implies a potential return of 0.5% over the closing price of $135.28 as of August 17, 2017.

Investors can hold International Flavors and Fragrances indirectly by investing in the iShares U.S. Basic Materials ETF (IYM), which has invested 1.8% of its portfolio in IFF. This ETF also provides exposure to PPG Industries (PPG) with a weight of 4.4% as of August 17, 2017.

In the next part, we’ll look into IFF’s valuations.