US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

Jan. 3 2017, Published 12:00 p.m. ET

US Dollar Index

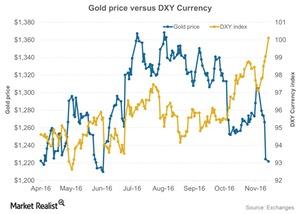

As we discussed in the last part, most of the changes in gold are determined by the US dollar. The US dollar touched its 14-year high level during December 2016. The US Dollar Index measures the dollar against a basket of six major world currencies. As the Fed boosted the interest rate on Treasuries during the last month, the dollar rose significantly. The rising interest rate on US Treasuries makes the US dollar more lucrative.

Movements in gold and the US dollar are shown in the following graph. As you can see, they mainly have an inverse relationship. The higher the dollar, the lower the demand for dollar-denominated assets. Optimism in the overall US economy could boost the dollar.

However, as the year came to an end, the dollar closed below the ten-day moving average. The support for the US Dollar Index is 100.5–101.5.

Correlation between the US dollar and gold

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions. Silver’s correlation with the US Dollar Index is -0.32.

Changes due to the dollar’s movements can be seen in mining funds such as the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR). These two funds saw massive year-to-date rises alongside precious metals, but they fell during the past month.

The rising dollar can also have a negative impact on mining stocks. Recently, some of the mining stocks that fell due to falling precious metals include Alacer Gold (ASR), Royal Gold (RGLD), New Gold (NGD), and Silver Wheaton (SLW).