Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

Nov. 20 2020, Updated 2:53 p.m. ET

Capacity cuts

China’s top steelmaking province, Hebei, announced to cut ~32 million more tons of steelmaking capacity in 2017. China has been reeling under its overcapacity in the steel industry. In 2016, while the planned capacity reduction was 45 million tons, according to MVS estimates, the figure wound up being almost double at 80 million tons.

Overcapacity

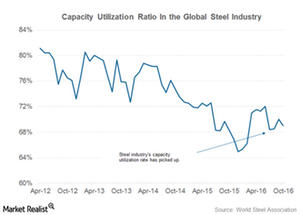

Generally, utilization ratios of over 80% are regarded as a healthy sign for an industry. Although the steel industry’s capacity utilization ratio has picked up over the last few months, there’s still quite a bit of overcapacity.

The NDRC’s (National Development and Reform Commission) top official, Xu Shaoshi, said on January 10, 2017, that China will put more pressure on coal and steel firms to reduce their overcapacity this year. He also mentioned that the cut in steel and coal capacity in 2016 impacted the jobs of 800,000 miners and steelworkers.

Shaoshi stated: “This year’s task will be more arduous, but we will adhere to the main line.” Notably, China’s 2017 capacity cuts could be crucial for a sustainable recovery in global steel markets. According to some analysts, 2016 capacity cuts were more of a window dressing exercise, as most of the curtailed capacity was idled anyway.

Notably, China’s 2017 capacity cuts could be crucial for a sustainable recovery in global steel markets. According to some analysts, 2016 capacity cuts were more of a window dressing exercise, as most of the curtailed capacity was idled anyway.

Capacity cuts and steel industry

If China cuts its steel capacity—which it may have to do, despite its apparent reluctance—there could be better days ahead for the global steel industry. China’s steel futures recently jumped on the news of capacity cuts. Shanghai steel futures jumped 7% on Tuesday, January 9, 2016.

This led the raw material prices of iron ore and coking coal to rally. Sustained capacity rationalization could lead to higher steel prices, which should support iron ore prices. This will also be positive for miners (XME) such as Rio Tinto (RIO), BHP Billiton (BHP) (BBL), Vale (VALE), and Cliffs Natural Resources (CLF).